11.3 Corporate Governance

The Many Roles of Boards of Directors

“You’re fired!” is a commonly used phrase most closely associated with Donald Trump as he dismissed candidates on his reality show, The Apprentice. But who would have the power to utter these words to today’s CEOs, whose paychecks are on par with many of the top celebrities and athletes in the world? This honor belongs to the board of directors—a group of individuals that oversees the activities of an organization or corporation.

Potentially firing or hiring a CEO is one of many roles played by the board of directors in their charge to provide effective corporate governance for the firm. An effective board plays many roles, ranging from the approval of financial objectives, advising on strategic issues, making the firm aware of relevant laws, and representing stakeholders who have an interest in the long-term performance of the firm (Table 11.1 “Board Roles”). Effective boards may help bring prestige and important resources to the organization. For example, General Electric’s board often has included the CEOs of other firms as well as former senators and prestigious academics. Blake Mycoskie of TOMS Shoes was touted as an ideal candidate for an “all-star” board of directors because of his ability to fulfill his company’s mission “to show how together we can create a better tomorrow by taking compassionate action today” (Bunting, 2011).

One of the key stakeholders of a corporation is generally agreed to be the shareholders of the company’s stock. Most large, publicly traded firms in the United States are made up of thousands of shareholders. While 5% ownership in many ventures may seem modest, this amount is considerable in publicly traded companies, where such ownership is generally limited to other companies, and ownership in this amount could result in representation on the board of directors.

The possibility of conflicts of interest is considerable in public corporations. A conflict of interest exists when a person could receive personal benefit from decisions they make in their official capacity. For example, if a firm’s purchasing agent’s husband owns an office supply company that could sell products to the firm, the purchasing agent has a conflict of interest, On the one hand, CEOs favor large salaries and job stability, and these desires are often accompanied by a tendency to make decisions that would benefit the firm (and their salaries) in the short term at the expense of decisions considered over a longer time horizon. In contrast, shareholders prefer decisions that will grow the value of their stock in the long term. This separation of interest creates an agency problem wherein the interests of the individuals that manage the company (agents such as the CEO) may not align with the interest of the owners (such as stockholders).

The Ethisphere® Institute presents an annual listing of the #WorldsMostEthicalCompanies at https://www.worldsmostethicalcompanies.com/honorees.

The composition of the board is critical because the dynamics of the board play an important part in resolving the agency problem. However, who exactly should be on the board is an issue that has been subject to fierce debate. CEOs often favor the use of board insiders who often have intimate knowledge of the firm’s business affairs. In contrast, many institutional investors such as mutual funds and pension funds that hold large blocks of stock in the firm often prefer significant representation by board outsiders that provide a fresh, unbiased perspective concerning a firm’s actions.

One particularly controversial issue in regard to board composition is the potential for CEO duality, a situation in which the CEO is also the chairman of the board of directors. This has also been known to create a bitter divide within a corporation.

For example, during the 1990s, The Walt Disney Company was often listed in BusinessWeek’s rankings for having one of the worst board of directors (Lavelle, 2002). In 2005, Disney’s board forced the separation of then CEO (and chairman of the board) Michael Eisner’s dual roles. Eisner retained the role of CEO but later stepped down from Disney entirely. Disney’s story reflects a changing reality that boards are acting with considerably more influence than in previous decades when they were viewed largely as rubber stamps that generally folded to the whims of the CEO.

William Shakespeare once wrote, “All the world’s a stage, and the men and women merely players.” This analogy applies well to boards of directors. When the performance of board members is impressive, the company is able to put on a dynamic show. But if a board member phones in their role, failure may soon follow. Discussed below are the different roles board members may play.

| Roles of Board Members | |

| Accountant | Board members may, at times, approve financial objectives. |

| Lawyer | Ensuring the firm complies with applicable laws is a key role. |

| Advisor | Providing advice on strategic issues is a critical role that is overlooked by less effective boards. |

| Activist | Boards must ensure the rights and interests of stakeholders (especially stockholders) are represented. |

| Human Resource Manager | Boards must monitor the CEO and engage in hiring, firing, and the administration of CEO compensation. |

| Agent | Because board members may serve in powerful positions at other companies, a well-networked board member may be able to bring new connections to the firm. |

Managing CEO Compensation

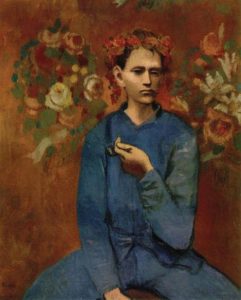

One of the most visible roles of boards of directors is setting CEO pay. The valuation of the human capital associated with the rare talent possessed by some CEOs can be illustrated in a story of an encounter one tourist had with the legendary artist Pablo Picasso. As the story goes, Picasso was once spotted by a woman sketching. Overwhelmed with excitement at the serendipitous meeting, the tourist offered Picasso fair market value if he would render a quick sketch of her image. After completing his commission, she was shocked when he asked for five thousand francs, responding, “But it only took you a few minutes.” Undeterred, Picasso retorted, “No, it took me all my life” (Kay, 1999).

This story illustrates the complexity associated with managing CEO compensation. On the one hand, large corporations must pay competitive wages for the scarce talent that is needed to manage billion-dollar corporations. In addition, like celebrities and sport stars, CEO pay is much more than a function of a day’s work for a day’s pay. CEO compensation is a market driven function of the competitive wages that other corporations would offer for a potential CEO’s services.

On the other hand, boards will face considerable scrutiny from investors if CEO pay is out of line with industry norms. From the year 1980 to 2000, the gap between CEO pay and worker pay grew from 42 to 1 to 475 to 1 (Blumenthal, 2000). Although efforts to close this gap have been made, as recently as 2019 reports indicate the ratio continues to be as high as 278 to 1. This is much higher than other countries, for example, Germany’s is half the US ratio (Cox, 2019). Meanwhile, shareholders need to be aware that research studies have found that CEO pay is positively correlated with the size of firms—the bigger the firm, the higher the CEO’s compensation (Tosi et al., 2000). Consequently, when a CEO tries to grow a company, such as by acquiring a rival firm, shareholders should question whether such growth is in the company’s best interest or whether it is simply an effort by the CEO to get a pay raise.

Within American firms, the average CEO is paid over 200 times what the typical worker makes—one of the highest ratios in the world. Many CEOs also receive perks that the average employee could only dream possible. Such perks are trouble to the extent that they reflect the board’s lack of vigilance in monitoring CEO spending. We illustrate a few examples below.

| Perks of Being a CEO |

| Former Tyco CEO Dennis Koslowski—now a convicted felon—threw a week-long $2 million birthday bash for his wife that included an ice-sculpture of Michelangelo’s David that dispensed vokda—top shelf, of course! |

| A pint-sized matter compared to the lavish perks of many executives, the sweet tooth should be satisfied for former Ben & Jerry’s CEO Robert Holland Jr., who will receive free ice cream for life. |

| Golden parachutes where CEOs receive large cash settlements if fired are common in publicly traded companies. Less common is the “golden coffin” that provides big settlements if an executive passes away in office. Abercrombie & Fitch CEO Michael Jefferies was offered $6 million for his loyalty to the company…dead or alive. |

| Foreclosure! Countrywide Financial, now owned by Bank of America, paid nearly $1 million for their executives’ country club memberships between 2003 through 2006. |

| Although Don Tyson of Tyson Foods retired in 2001, Tyson employees mowed his yard and cleaned his house to keep things tidy post retirement. |

In most publicly traded firms, CEO compensation generally includes guaranteed salary, cash bonus, and stock options. But perks provide another valuable source of CEO compensation (Table 11.4 “CEO Perks”). In addition to the controversy surrounding CEO pay, such perks associated with holding the position of CEO have also come under considerable scrutiny. The term perks, derived from perquisite, refers to special privileges, or rights, as a function of one’s position. CEO perks have ranged in magnitude from the sweet benefit of ice cream for life given to former Ben & Jerry’s CEO Robert Holland, to much more extreme benefits that raise the ears of investors while outraging employees. One such perk was provided to John Thain who, as former head of NYSE Euronext, received more than $1 million to renovate his office. While such perks may provide powerful incentives to stay with a company, they may result in considerable negative press and serve only to motivate vigilant investors wary of the value of such investments to shop elsewhere.

As noted earlier in this chapter, sometimes CEOs get involved in corporate scandals, seeking their own self interest instead of the best interests of the company. But this problem can be much more subtle than creating a scandal, and not limited to CEOs. An agency problem exists whenever an “agent” of the company, typically senior management, acts in their own self interest at the expense of the best interests of the firm. For example, a CEO may push for the acquisition of another company to enhance his or her salary and legacy when that acquisition is not a wise move. They may decide to expand into Spain instead of the United Kingdom because they prefer to travel to sunny Spain with its great food instead of the rainy United Kingdom, even though the United Kingdom is the better choice. Selfish or self-centered motives can influence decision making in ways that are difficult to detect. At times, the decision maker may feel justified in the decision and not realize their impure motives behind the decision. The board of directors and the decision makers themselves need to recognize that the agency problem exists and guard against it in their organization. The agency problem also exists in politics, and at times politicians are accused of making decisions that benefit themselves over their constituents.

The Market for Corporate Governance

The terms associated with mergers, acquisitions, and the actions used by executives to block these moves often sound like material from the latest war movie. We explain important terms below.

| While a pirate raids a competitor’s vessel looking to loot valuable treasures, a corporate raider invades a firm by purchasing its stock. | Hostile takeover refers to an attempt to purchase a company that is strongly resisted by the target firm’s CEO and/or board. |

| Defenses against takeovers are often referred to as shark repellent. We illustrate a few below. | |

| A golden parachute is a financial package (often including stock options and bonuses worth millions of dollars) given to executives likely to lose their jobs after a takeover. These parachutes make taking over a firm more costly and thus less attractive. | When executives are desperate to avoid a takeover they may be forced to swallow a poison pill. This involves making the firm’s stock unattractive to raiders by letting shareholders buy stock at a discount. |

| A firm that rescues a target firm by offering a friendly takeover as an alternative to a hostile one is known as a white knight. |

In contrast to blackmail, where information is withheld unless a demand is met, greenmail occurs when an unfriendly firm forces a target company to repurchase a large block of stock at a premium to thwart a takeover attempt.

|

An old investment cliché encourages individuals to buy low and sell high. When a publicly traded firm loses value, often due to lack of vigilance on the part of the CEO and/or board, a company may become a target of a takeover wherein another firm or set of individuals purchases the company. Generally, the top management team is charged with revitalizing the firm and maximizing its assets.

In some cases, the takeover is in the form of a leveraged buyout (LBO) in which a publicly traded company is purchased with sizable debt and then taken off the stock market. One of the most famous LBOs was of RJR Nabisco, which inspired the book (and later film) Barbarians at the Gate. LBOs are historically associated with reduction in workforces to streamline processes and decrease costs. The managers who instigate buyouts generally bring a more entrepreneurial mind-set to the firm with the hopes of creating a turnaround from the same fate that made the company an attractive takeover target (recent poor performance) (Wright et al., 2001).

Many takeover attempts increase shareholder value. However, because most takeovers are associated with the dismissal of previous management, the terminology associated with change of ownership has a decidedly negative slant against the acquiring firm’s management team. For example, individuals or firms that hope to conduct a takeover are often referred to as corporate raiders. An unsolicited takeover attempt is often dubbed a hostile takeover, with shark repellent as one of the potential defenses against such attempts. Although the poor management of a targeted firm is often the reason such businesses are potential takeover targets, when another firm that may be more favorable to existing management enters the picture as an alternative buyer, a white knight is said to have entered the picture (Table 11.3 “Takeover Terms”).

The negative tone of takeover terminology also extends to the potential target firm. CEOs as well as board members are likely to lose their positions after a successful takeover occurs, and a number of anti-takeover tactics have been used by boards to deter a corporate raid. For example, many firms are said to pay greenmail by repurchasing large blocks of stock at a premium to avoid a potential takeover. Firms may threaten to take a poison pill where additional stock is sold to existing shareholders, increasing the shares needed for a viable takeover. Even if the takeover is successful and the previous CEO is dismissed, a golden parachute that includes a lucrative financial settlement is likely to provide a soft landing for the ousted executive.

Section Video

Role of the Board in Creating an Ethical Corporate Culture [06:48]

The video for this lesson describes the role of the board in creating an ethical corporate culture.

You can view this video here: https://youtu.be/kOm8SC8qI4w.

Key Takeaway

- Firms can benefit from superior corporate governance mechanisms such as an active board that monitors CEO actions, provides strategic advice, and helps to network to other useful resources. When such mechanisms are not in place, CEO excess may go unchecked, resulting in negative publicity, poor firm performance, and the potential for a takeover by other firms. An agency problem exists when the CEO acts in their own best interest instead of the best interest of the firm.

Exercises

- Divide the class into teams and see who can find the most egregious CEO perk in the last year.

- Find a listing of members of a board of directors for a Fortune 500 firm. Does the board seem to be composed of individuals who are likely to fulfill all the board roles effectively?

- Research a hostile takeover in the past five years and examine the long-term impact on the firm’s stock market performance. Was the takeover beneficial or harmful for shareholders?

- Examine the AFL-CIO Executive Paywatch website https://aflcio.org/paywatch and select a company of interest to see how many years you would need to work to earn a year’s pay enjoyed by the firm’s CEO.

References

Blumenthal, R. G. (2000, September 4). The pay gap between workers and chiefs looks like a chasm. Barron’s, 10.

Bunting, C. (2011, February 23). Board of dreams: Fantasy board of directors. Business News Daily. http://www.businessnewsdaily.com/681-board-of-directors-fantasy-picks-small-business.html.

Cox, J. (2019, August 16). CEOs see pay grow 1,000% in the last 40 years, now make 278 times the average worker. CNBC. https://www.cnbc.com/2019/08/16/ceos-see-pay-grow-1000percent-and-now-make-278-times-the-average-worker.html.

Kenton, W. (2020). Sarbanes-Oxley (SOX) Act of 2002. Investopedia. https://www.investopedia.com/terms/s/sarbanesoxleyact.asp.

Kay, I. (1999). Don’t devalue human capital. Wall Street Journal—Eastern Edition, 233, A18.

Lavelle, L. (2002, October 7). The best and worst boards: How corporate scandals are sparking a revolution in governance. BusinessWeek, 104.

Tosi, H. L., Werner, S., Katz., J. P., & Gomez-Mejia, L. R. (2000). How much does performance matter? A meta-analysis of CEO pay studies. Journal of Management, 26, 301–339.

Wright, M., Hoskisson, R. E., & Busenitz, L. W. (2001). Firm rebirth: Buyouts as facilitators of strategic growth and entrepreneurship. Academy of Management Executive, 15, 111–125.

Image Credits

Figure 11.2: Picasso, Pablo. “Garçon à la Pipe.” Public Domain. Retrieved from https://en.wikipedia.org/wiki/File:Garçon_à_la_pipe.jpg.

Video Credits

Markkula Center for Applied Ethics. 2013, November 26. Role of the Board in Creating an Ethical Corporate Culture. Retrieved from https://youtu.be/kOm8SC8qI4w.

When a person could receive personal benefit from decisions they make in their official capacity

When the interests of the individuals that manage the company (agents such as the CEO) may not align with the interest of the owners (such as stockholders)