5 The Intersection of Sustainable Property Management and Risk Management

Chapter Contents

5.1 Introduction

5.2 The Risk Management Process Model

5.3 Environmental Risk Management

5.5 Governance Risk Management

5.6 Conclusion

Learning Objectives

- Describe the risk management process model

- Identify environmental risk management components

- Identify social risk management components

- Identify governance risk management components

- Describe how ESG risk management concepts relate to sustainable property management

5.1 Introduction

The human condition tends to consider immediate risks more frequently than distant risks. However, both types of risks are important when considering the sustainability and resiliency of a real estate asset. The process of risk management first identifies property liabilities and then assesses associated control measures; risk management actions are then carried out to bring these risks within acceptable levels. Risk management helps protect the property and associated stakeholders such as building occupants, the building owner, and the property management company.

The incorporation of sustainability measures through the utilization of the ESG reporting framework can identify and address risks to create a more resilient property and organization. ESG, introduced in chapter 1, stands for environmental, social, and governance. This chapter will cover various environmental, social, and governance risks and associated risk management initiatives as investors are increasingly using the ESG framework for decision-making in their investments.

5.2 The Risk Management Process Model

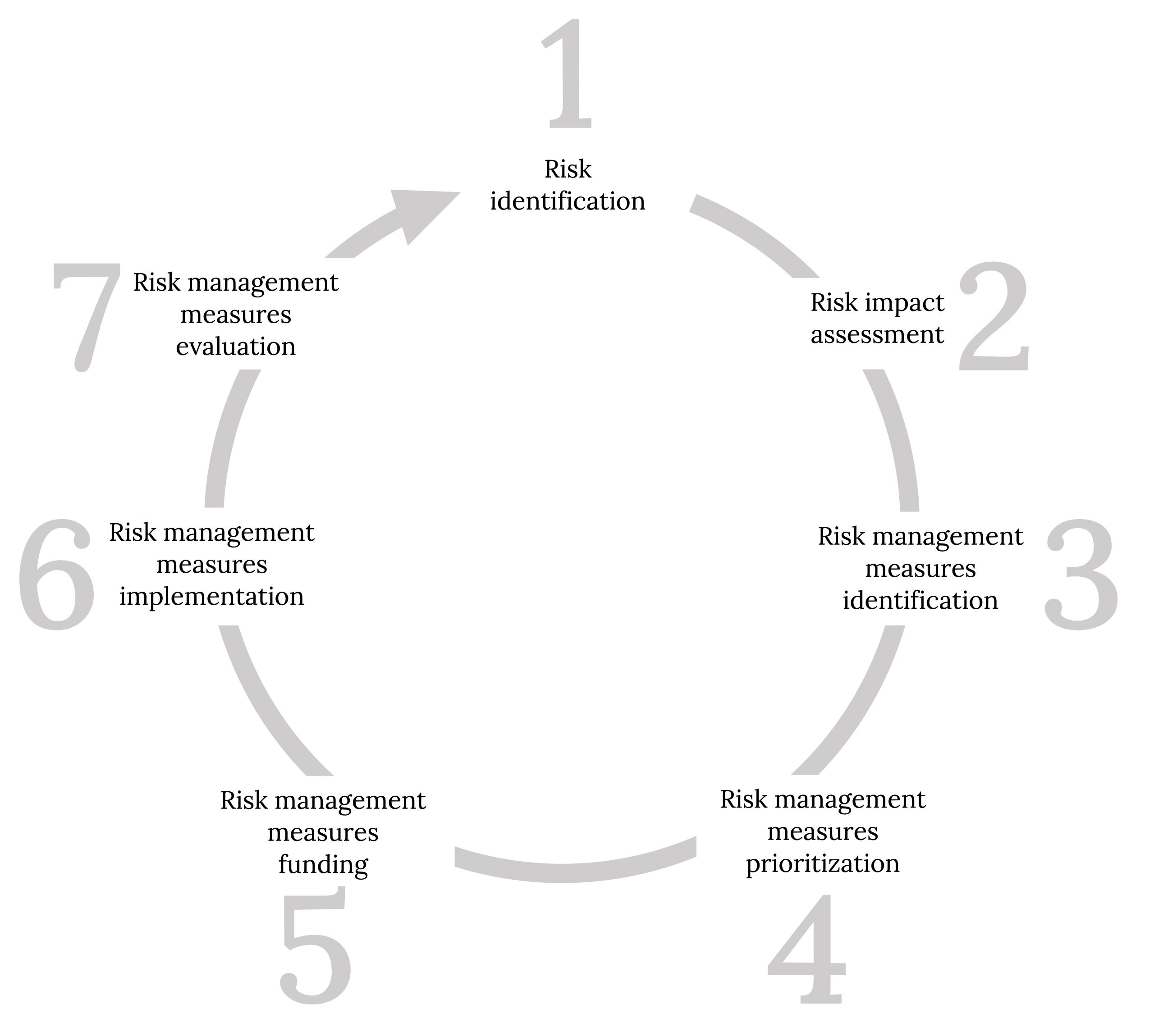

The risk management process model, as illustrated in figure 5.1, can be applied to all ESG components. The model is depicted as a circle with arrows representing a cycle and iterative process that takes place continually versus just one time. The first step is to identify potential risks and the likelihood of occurrence of these risks. The next steps are to assess the impact of these potential risks on the property and then identify measures to respond to these risks to avert, minimize, and address damages and losses. This process is sometimes referred to as a gap analysis, as it assesses current business practices and the changes that need to be made in order to close the gap on these shortcomings. Once risk management measures are identified, they need to be prioritized and then funded based on priority. The last steps are to implement the measures and evaluate the risk management measures in place. This evaluation identifies any necessary changes that should be made. It is important that these risk management processes be performed at the asset level of a building portfolio on an ongoing basis, as identified risks and associated risk management measures may change throughout time. Also, identified risks and associated risk management measures will vary by property depending on location, product type, size, age, occupant mix, and turnover frequency.

5.3 Environmental Risk Management

Environmental risk management examples include climate risk management, environmental regulation management, and resource management.

Climate Risk Management

Climate science shows average temperatures are rising, which is causing greater frequency and severity of climate risks such as flooding, wildfires, hurricanes, earthquakes, rise in sea level, droughts, and a sustained trend toward increased average temperatures. In a report released in 2018, inland flood risk, sea level rise and coastal floods, and hurricanes or typhoons were used as climate risk factors to assess the amount of real estate exposure to climate hazards in the United States. Of the 73,500 properties owned by 321 real estate investment trusts (REITs), 35 percent were identified to be exposed to these climate risk hazards (Starkman, 2018). Examples of location-based climate risks include hurricane damage to beachfront condo towers in Miami, first-floor and basement unit flooding in New York City, and drought in Nevada and California, which puts pressure on the development of new units as well as threatens existing assets.

The first step in climate risk management is to identify these potential physical risks and the likelihood of occurrence at the property. Once any physical risks are identified, the material impacts that may be caused to the property directly and indirectly should be spelled out. Examples include higher insurance premiums, higher energy bills for cooling the building space, and disruption in operations and resulting lower revenue. The next step is to identify measures to incorporate resilience to these physical risks at the property. Resilience can include durable property features such as xeriscaping to address drought risks.

Example: Climate Risk Management

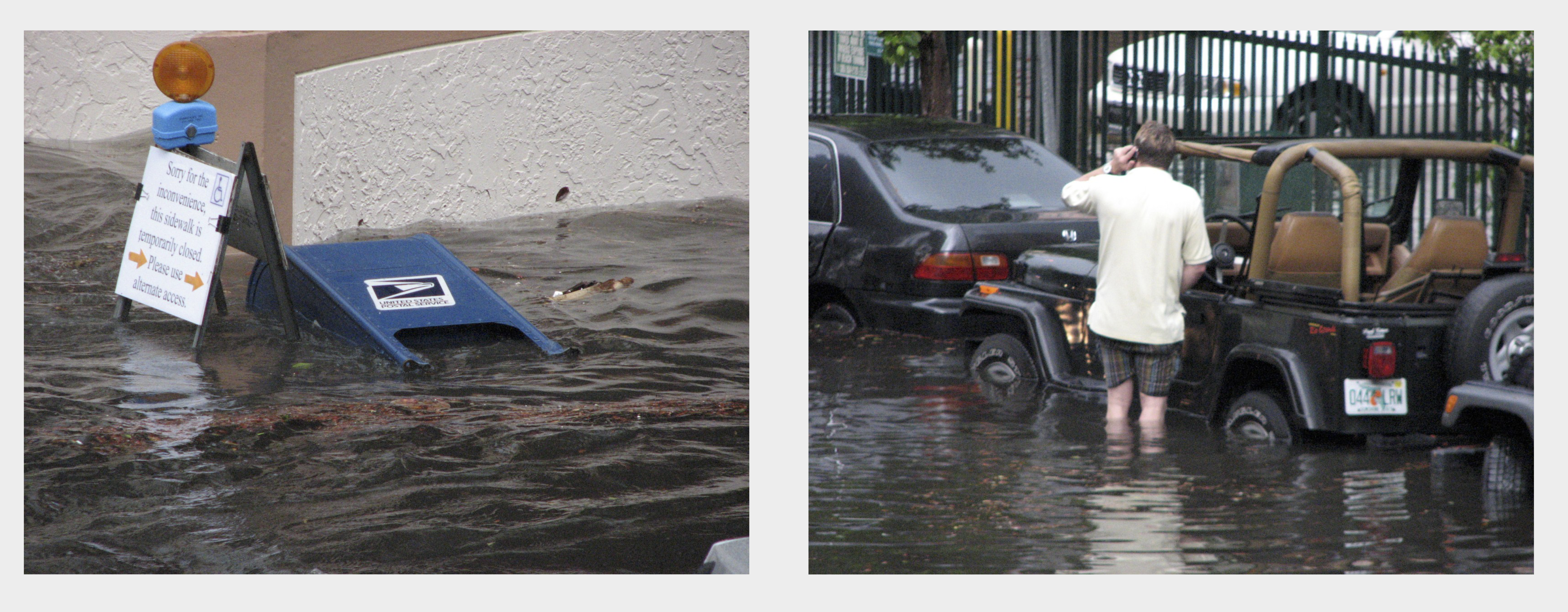

An example of climate risk management can be seen in Miami Beach, Florida. Figure 5.2 shows pictures of flooding in South Beach, Miami, that have increased in frequency and severity in recent years due to the rising sea level. The continued rise in sea level has required the City of Miami Beach to raise their streets by multiple feet. This risk management measure is obviously extremely expensive and time consuming, but something necessary if people continue to want to live, work, and play here.

Environmental Regulation Management

Environmental regulations are put forward with the goal of improving environmental quality and protecting human health. These types of regulations can be introduced at the federal, state, and/or local levels. A federal example is Section 608 of the Clean Air Act (CAA) that regulates the disposal of refrigeration air conditioning equipment (United States Environmental Protection Agency, 2011). This regulation is required by law and ensures that emissions of ozone-depleting substances are minimized during the disposal of this equipment. An example at the state level is Virginia’s High-Performance Buildings Act that requires electric vehicle–charging infrastructure installation for new state and local government building construction or renovation (Virginia Clean Cities, 2021). Locally, the City of San Francisco passed the Renewable Energy Law that requires private commercial buildings larger than 50,000 square feet to be powered by 100 percent renewable electricity (City and County of San Francisco, 2019).

A climate transition plan can reduce environmental regulation risk by preparing the property company for legislation that has recently been enacted or may be forthcoming relating to carbon taxes or lower carbon footprint requirements. A climate transition plan is a plan that lays out how the property and organization will adjust building operations to incorporate climate science recommendations. Holistically, property owners and management companies can incorporate a climate transition plan taking into account the building operations and organization-wide policies. Not only can a climate transition plan reduce environmental risk, as the decarbonization of buildings impacts climate change to the greatest degree, a climate transition plan can help organizations address climate change and support the transition toward a low-carbon economy.

Example: Climate Transition Plan

In April 2019, the city council in New York City approved Mayor Bill de Blasio’s (pictured in fig. 5.3) Climate Mobilization Act. This act is one of the most ambitious plans for reducing greenhouse gas emissions in the world and pledges New York City to carbon neutrality by 2050. Local Law 97 is part of this act and requires buildings to meet aggressive carbon reduction targets. Specifically, under this law most buildings over 25,000 square feet are mandated to meet new energy efficiency and greenhouse gas emission limits by 2024, and then stricter limits by 2030. The aim of the law is to reduce greenhouse gas emissions 40 percent by 2030 and 80 percent by 2050. Climate transition plans for these properties are essential to ensure compliance with these new local requirements and to reduce environmental regulation risk.

Resource Management

Resource management takes into account how resources such as energy, water, and waste are handled at the property. Value is created and risk is lowered when energy and water consumption are lowered and there is less waste disposal at the property. Reductions in these resources lower operating costs immediately and potentially can lower operating costs further should environmental regulations be imposed, such as a carbon tax.

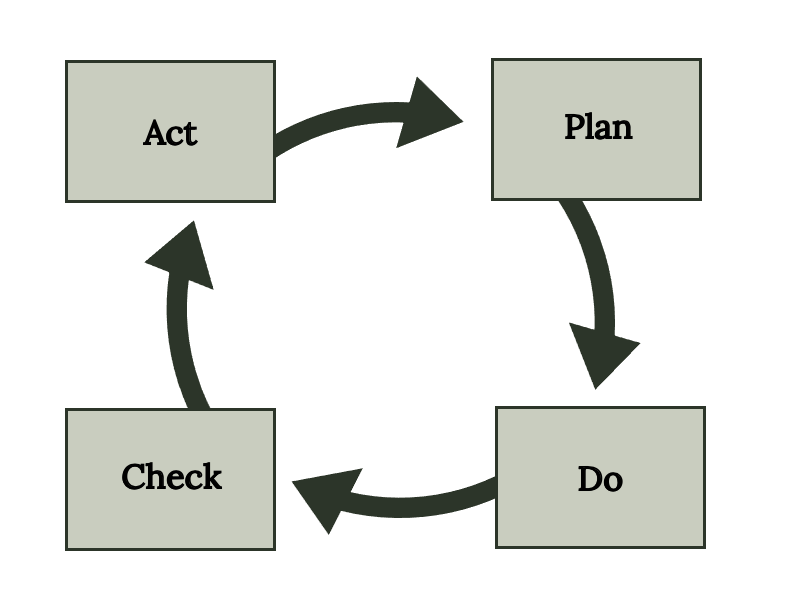

An Environmental Management System (EMS) is a helpful framework to address resource management risks by increasing operational efficiency and mitigating environmental impacts. Each EMS is customized to a particular property and is a process to continually review and evaluate opportunities to improve the environmental performance of the property. As illustrated in figure 5.4, the EMS process includes planning environmental goals of the property based on environmental impacts and requirements of the property, establishing goals and programs to reduce these environmental impacts, reviewing and evaluating the progress of the EMS in achieving these property goals, and acting based on this review and evaluation. It is important to note that a risk management measure that is feasible at one property or company may not be reasonable or feasible for another property or company. Company and property resources must be considered.

Section Video

What is ISO 14001 Environment Management Systems EMS training

[00:02:13] Best Practice. https://youtu.be/XDaNmdBPwqM

Section References

City and County of San Francisco. (2019, September 17). Board of supervisors votes unanimously to power San Francisco’s downtown with 100 percent renewable electricity. https://sfmayor.org/article/board-supervisors-votes-unanimously-power-san-franciscos-downtown-100-percent-renewable

Starkman, K. (2018). Climate risk, real estate, and the bottom line. https://www.preventionweb.net/news/report-climate-risk-real-estate-and-bottom-line

United States Environmental Protection Agency. (2011, February). Construction and demolition: How to properly dispose of refrigeration and air-conditioning equipment. https://www.epa.gov/sites/default/files/documents/ConstrAndDemo_EquipDisposal.pdf

Virginia Clean Cities. (2021, June 3). High performance buildings act take effect on July 1. https://vacleancities.org/high-performance-buildings-act-take-effect-on-july-1/

5.4 Social Risk Management

Social risk management examples include health and safety measures, effective supply chain management, and diversity and inclusion measures.

Health and Safety Measures

Health and safety risks of the building occupants, employees, contractors, and community are important considerations. Exposure to these risks can open up the property and organization to a negative reputation and potential criminal consequences. It can also decrease stakeholder satisfaction, which can subsequently reduce revenue. To build a more resilient business, the real estate organization must invest in the health and safety of these stakeholders. Examples include implementing procedures to prevent workplace injuries, providing good ventilation with access to fresh air and clean water, and providing a tobacco-free work environment.

Effective Supply Chain Management

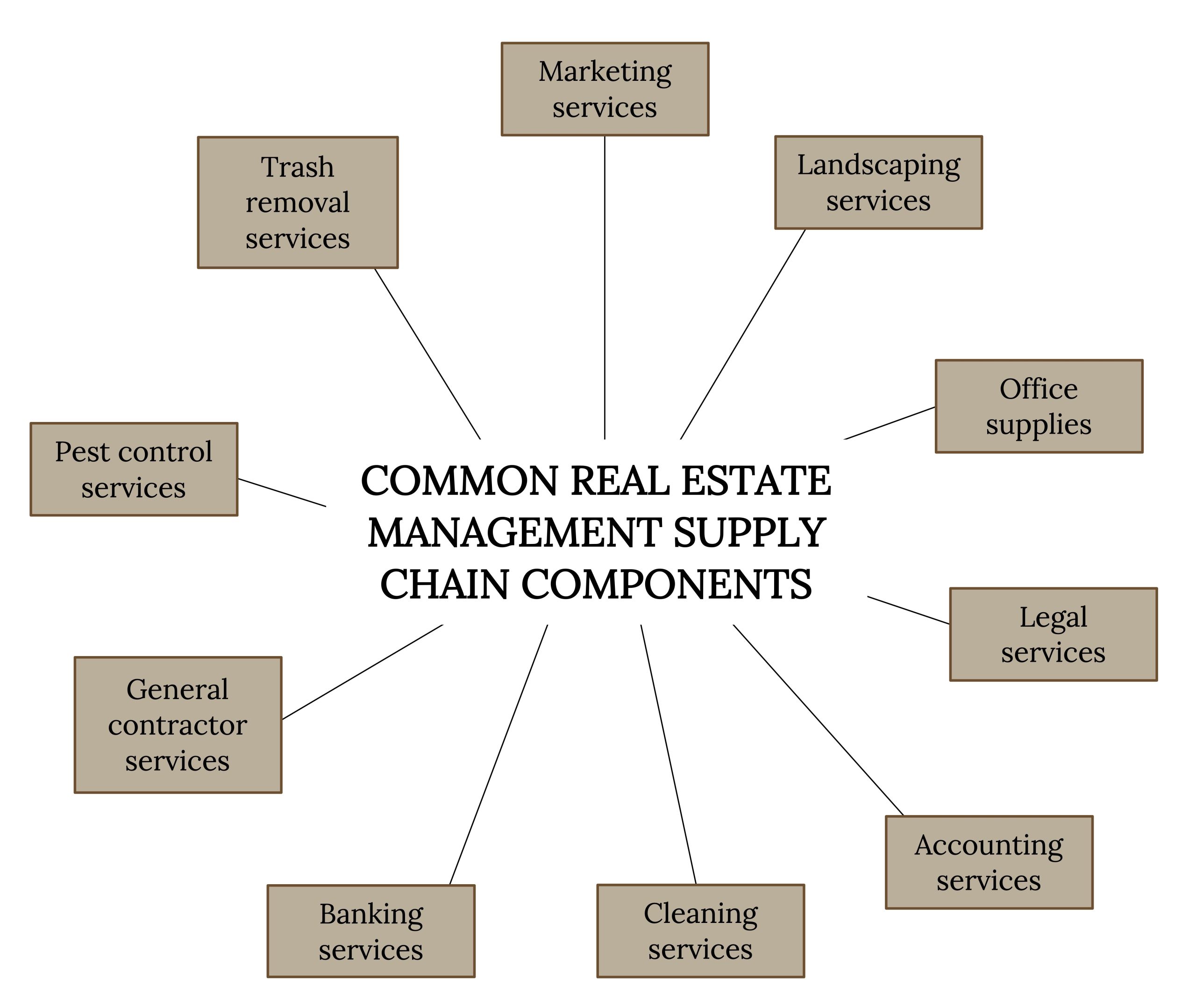

A supply chain refers to services and supplies used to operate the property and organization. As illustrated in figure 5.5, common components of a property management supply chain include accounting services, banking services, cleaning services, general contractor services, landscaping services, legal services, marketing services, office supplies, pest control services, and trash removal services. General contractor services include HVAC, plumbing, and electrical maintenance and repair. Engaging with the supply chain on ESG issues and detailing out the standards between the property and vendor can decrease risk exposure. This is because effective supply chain management helps reduce operating costs and avoid supply shortages. A disruption in the property’s supply chain can put a strain on purchasing and contracting strategies already in place and also impact the property’s reputation. This can impact financial performance because of an increase in price from suppliers and a lack of availability, causing a decrease in occupant satisfaction and resulting lost revenue should they choose to go to another property.

Diversity and Inclusion Measures

Diversity and inclusion are often referred to together, but are not synonymous. Diversity refers to the characteristics that make individuals unique, including race, gender, age, ethnicity, sexual orientation, abilities, and others. Inclusion refers to creating a culture where everyone feels a sense of belonging and is valued for their unique perspectives and contributions. A social risk assessment can be performed to evaluate the degree to which diversity and inclusion are part of the environment. At the organizational level, this can include examining the gender ratio, gender pay gaps, age group distribution, racial diversity, and board of directors composition. This is important, as the inclusion of a diverse workforce decreases exposure to risk by increasing the perspectives for problem solving and increasing the competitive profile for the property management company.

At the property level, an apartment community example is offering inclusive programming to include households with and without children. A mixed-use example is ensuring access for people with disabilities or who are elderly, as well as using the common area for a range of different programming initiatives. These types of initiatives can help building users feel more welcomed and valued.

5.5 Governance Risk Management

Governance risk management examples include disclosure, implementation strategies, and cybersecurity.

Disclosure

ESG disclosure is important for transparency and showcases ESG activities being performed at the property and organizational levels. Disclosure opportunities include investor reporting, an exclusive ESG report, GRESB participation, and a section dedicated to ESG on the property and organization website. Disclosing ESG activities illustrates consideration and management of ESG risks and can increase resiliency. Disclosure can also help attract investors who are increasingly concerned with a company’s ESG initiatives.

Implementation Strategies

The strategies for implementing ESG policies are important because they provide pathways for policy implementation. Thoughtfully creating these pathways can manage risk so that the ESG risk management measures are effectively implemented at the property level and within the organization. Some strategies to consider include creation of an ESG committee tasked with monitoring and evaluating ESG initiatives. It is important that senior management decision makers are included on this task force so that ESG policies are more easily applied throughout the organization. Another strategy is to create a standardized checklist that can be used at each property to evaluate sustainability broken into E, S, and G component sections. This can foster easier implementation of ESG initiatives at the property level. Also, making a commitment to public ESG leadership principles is a strategy that can showcase commitment and also help inform ESG policies within the property and organization. An example of such public ESG principles are the United Nations’ Sustainable Development Goals (SDGs) as listed in figure 5.6. These seventeen interconnected goals, introduced in 2015 with the intention to be achieved by 2030, provide pathways for a more sustainable future for all. The Royal Institution of Chartered Surveyors (RICS), a global organization that creates and enforces standards related to real estate, has partnered with the United Nations Global Compact to make it easier for real estate companies to implement the SDGs throughout real estate businesses. They have done this through creation of a document titled “Advancing Responsible Business in Land, Construction, Real Estate Use and Investment—Making the Sustainable Development Goals a Reality” that provides resources such as a toolbox, case studies, and self-assessment checklist. Further information on this resource can be found at: https://www.rics.org/north-america/about-rics/responsible-business/un-sustainable-development/.

Cybersecurity

Cybersecurity refers to the protection of the networking system, hardware, software, and data of a property and organization from cyberattacks. A cyberattack can target computer networks, infrastructure or computer devices, with $200,000 being the average cost of a cyberattack on a business (Steinberg, 2020). This is a significant threat for the sustainability of the real estate organization, and policies should be implemented to incorporate cybersecurity into property management operations. Examples of cybersecurity initiatives include installation of anti-virus software, stronger password requirements, multi-factor authentication, encrypted networks, and data backup policies. These initiatives can reduce risks of a cyberattack.

Section Video

Do you know all 17 SDGs?

[00:01:24] United Nations. https://youtu.be/0XTBYMfZyrM

Section Reference

Steinberg, S. (2020, March 9). Cyberattacks now cost companies $200,000 on average, putting many out of business. CNBC. https://www.cnbc.com/2019/10/13/cyberattacks-cost-small-companies-200k-putting-many-out-of-business.html

5.6 Conclusion

This chapter introduced the risk management process model that can be applied to environmental, social, and governance risk management components both at the property and organization levels. ESG initiatives are interconnected and provide a holistic look at risk management. ESG initiatives can be implemented at the property, property portfolio, and organizational levels and should contain goals that are measurable and reasonable. Risk management initiatives will vary depending on the property age, location, size, condition, occupant mix, and turnover frequency. While this chapter introduces a sampling of ESG risk management components, by no means is it an exhaustive list. Furthermore, the ESG framework has limitations. The measurement of ESG performance is complex and requires data that companies may not have previously collected, which can cause inaccurate results. Also, applying a single global benchmark to real estate assets, which inherently are not homogeneous, can cause ESG ratings to be imprecise. But a basic understanding of ESG risk management components is necessary in this environment where investors are increasingly using ESG components to make investment decisions.

Discussion Questions

- What is an example of the E of ESG as applied to property management, and how does this example address risk management?

- What is an example of the S of ESG as applied to property management, and how does this example address risk management?

- What is an example of the G of ESG as applied to property management, and how does this example address risk management?

- What is your key takeaway from this chapter? In which section did you find it?

Activities

- Research the rising sea level issues in Miami Beach, FL, and answer the questions below:

- Is real estate still being built near the water in Miami Beach? Why or why not?

- Using ESG as a framework, what are the risks of continuing to build real estate near the water in Miami Beach, FL?

- Is it ethical to build real estate near the water in Miami Beach, FL? Why or why not?

- Research a local environmental regulation that affects buildings and provide the following details:

- Where was it passed?

- When was it passed?

- What is the goal of the law?

- Is there a plan in place to help buildings comply with the law?

- What is your reaction to the law?

- Find a real estate company’s ESG plan and summarize the plan. Is there anything that particularly stands out to you? Why?

- Refer to the UN’s website on the SDGs (https://www.un.org/sustainabledevelopment/sustainable-development-goals/) and choose five SDGs and how you can apply them to property management operations.

Figure References

Figure 5.1: Risk management process model. Kindred Grey. (2023). CC BY 4.0.

Figure 5.2: Flooding in South Beach, Miami, Florida. Left image: maxstrz. (2009). CC BY 2.0. https://flic.kr/p/6u5gkd Right image: maxstrz. (2009). South Beach flood. https://flic.kr/p/6u17PM. CC BY 2.0

Figure 5.3: Image of Mayor Bill de Blasio (New York City mayor from 2014-2021). KevinCase. (2013). NYC Mayor Bill de Blasio. https://flic.kr/p/hcxKLM. CC BY 2.0

Figure 5.4: EMS process model. Kindred Grey. (2023). CC BY 4.0

Figure 5.5: Common property management supply chain components. Kindred Grey. (2023). CC BY 4.0

Figure 5.6: United Nations’ SDGs. Kindred Grey. (2023). Adapted from The 17 Goals. (n.d.). United Nations Department of Economic and Social Affairs. (https://sdgs.un.org/goals). CC BY 4.0

Image Descriptions

Figure 5.1: The circular model begins with 1) Risk identification, 2) Risk impact assessment, 3) Risk management measures identification, 4) Risk management measures prioritization, 5) Risk management measures funding, 6) Risk management measures implementation, 7) Risk management measures evaluation. Return to figure 5.1.

Figure 5.2: Left: A sign directs pedestrians away from a flooded sidewalk with an overturned post office collection container. Right: A person stands in knee-high deep flood waters next to a vehicle in the street. Return to figure 5.2.

Figure 5.5: The components include these services: marketing, landscaping, office supplies, legal, accounting, cleaning, banking, general contractor, pest control, and trash removal. Return to figure 5.5.

Figure 5.6: Goal 1) no poverty, Goal 2) zero hunger, Goal 3) good health and well-being, Goal 4) quality education, Goal 5) gender equality, Goal 6) clean water and sanitation, Goal 7) affordable and clean energy, Goal 8) decent work and economic growth, Goal 9) industry, innovation, and infrastructure, Goal 10) reduced inequalities, Goal 11) sustainable cities and communities, Goal 12) responsible consumption and production, Goal 13) climate action, Goal 14) life below water, Goal 15) life on land, Goal 16) peace, justice, and strong institutions, Goal 17) partnerships. Return to figure 5.6.

A model used to minimize the negative impact of risks

The risk of climate change causing consequences to the property

Regulations at the federal, state, and/or local levels with the goal of improving environmental quality and protecting human health

A plan that lays out how the property and organization will adjust building operations to incorporate climate science recommendations

One of the most ambitious plans for reducing greenhouse gas emissions in the world, and pledges New York City to carbon neutrality by 2050

How resources such as energy, water, and waste are handled at a property

A framework to address resource management risks by increasing operational efficiency and mitigating environmental impacts

Services and supplies used to operate the property and organization

The characteristics that make individuals unique, including race, gender, age, ethnicity, sexual orientation, abilities, and others

Creating a culture where everyone feels a sense of belonging and is valued for their unique perspectives and contributions

Seventeen interconnected goals, introduced in 2015 with the intention to be achieved by 2030, that provide pathways for a more sustainable future for all

The protection of the networking system, hardware, software, and data of a property and organization from cyber attacks