Chapter 4 Ethics and Social Responsibility

Learning Objectives

- Define business ethics and explain what it means to act ethically in business.

- Explain why we study business ethics.

- Identify ethical issues that you might face in business, such as insider trading, conflicts of interest, and bribery, and explain rationalizations for unethical behavior.

- Identify steps you can take to maintain your honesty and integrity in a business environment.

- Define corporate social responsibility and explain how organizations are responsible to their stakeholders, including owners, employees, customers, and the community.

- Discuss how you can identify an ethical organization, and how organizations can prevent behavior like sexual harassment.

- Learn how to avoid an ethical lapse, and why you should not rationalize when making decisions.

Introduction

“Mommy, Why Do You Have to Go to Jail?”

The one question Betty Vinson would have preferred to avoid is “Mommy, why do you have to go to jail?”[1] Vinson graduated with an accounting degree from Mississippi State and married her college sweetheart. After a series of jobs at small banks, she landed a mid-level accounting job at WorldCom, at the time still a small long-distance provider. Sparked by the telecom boom, however, WorldCom soon became a darling of Wall Street, and its stock price soared. Now working for a wildly successful company, Vinson rounded out her life by reading legal thrillers and watching her daughter play soccer.

Her moment of truth came in mid-2000, when company executives learned that profits had plummeted. They asked Vinson to make some accounting adjustments to boost income by $828 million. Vinson knew that the scheme was unethical (at the very least) but she gave in and made the adjustments. Almost immediately, she felt guilty and told her boss that she was quitting. When news of her decision came to the attention of CEO Bernard Ebbers and CFO Scott Sullivan, they hastened to assure Vinson that she’d never be asked to cook any more books. Sullivan explained it this way: “We have planes in the air. Let’s get the planes landed. Once they’ve landed, if you still want to leave, then leave. But not while the planes are in the air.”[2] Besides, she’d done nothing illegal, and if anyone asked, he’d take full responsibility. So Vinson decided to stay. After all, Sullivan was one of the top CFOs in the country; at age 37, he was already making $19 million a year.[3] Who was she to question his judgment?[4]

Six months later, Ebbers and Sullivan needed another adjustment—this time for $771 million. This scheme was even more unethical than the first: it entailed forging dates to hide the adjustment. Pretty soon, Vinson was making adjustments on a quarterly basis—first for $560 million, then for $743 million, and yet again for $941 million. Eventually, Vinson had juggled almost $4 billion, and before long, the stress started to get to her: she had trouble sleeping, lost weight, and withdrew from people at work. She decided to hang on when she got a promotion and a $30,000 raise.

By spring 2002, however, it was obvious that adjusting the books was business as usual at WorldCom. Vinson finally decided that it was time to move on, but, unfortunately, an internal auditor had already put two and two together and blown the whistle. The Securities and Exchange Commission charged WorldCom with fraud amounting to $11 billion—the largest in US history. Seeing herself as a valuable witness, Vinson was eager to tell what she knew. The government, however, regarded her as more than a mere witness. When she was named a co-conspirator, she agreed to cooperate fully and pleaded guilty to criminal conspiracy and securities fraud. But she won’t be the only one doing time: Scott Sullivan will be in jail for five years, and Bernie Ebbers will be locked up for 25 years. Both maintain that they are innocent.[5]

So where did Betty Vinson, mild-mannered mid level executive and mother, go wrong? How did she manage to get involved in a scheme that not only bilked investors out of billions but also cost 17,000 people their jobs?[6] Ultimately, of course, we can only guess. Maybe she couldn’t say no to her bosses; perhaps she believed that they’d take full responsibility for her accounting “adjustments.” Possibly she was afraid of losing her job or didn’t fully understand the ramifications of what she was doing. What we do know is that she disgraced herself and went to jail.[7]

The WorldCom situation is not an isolated incident. Perhaps you have heard of Bernie Madoff, founder of Bernard L. Madoff Investment Securities and former chairman of the NASDAQ stock exchange.[8] Madoff is alleged to have run a giant Ponzi scheme[9] that cheated investors of up to $65 billion. His wrongdoings won him a spot at the top of Time Magazine’s Top 10 Crooked CEOs. According to the SEC charges, Madoff convinced investors to give him large sums of money. In return, he gave them an impressive 8–12 percent return a year. But Madoff never really invested their money. Instead, he kept it for himself. He got funds to pay the first investors their return (or their money back if they asked for it) by bringing in new investors. Everything was going smoothly until the fall of 2008, when the stock market plummeted and many of his investors asked for their money. As he no longer had it, the game was over and he had to admit that the whole thing was just one big lie. Thousands of investors, including many of his wealthy friends, not-so-rich retirees who trusted him with their life savings, and charitable foundations, were financially ruined. Those harmed by Madoff either directly or indirectly were likely pleased when he was sentenced to jail for 150 years.

Unfortunately, ethical issues are not isolated to Wall Street and corporate CEOs. In 2016, Wells-Fargo was found guilty for creating 1.5 million fake deposit accounts and more than 500,000 fake credit cards.[10] Even though then CEO John Stumpf was fired as a result of the scandal he did not act alone. The Wells-Fargo scandal involved hundreds of managers, supervisors, and tellers at every level of the organization. You or your family members may even have been directly impacted by the fake account activity. This case reminds us that all employees play a role or are affected by the ethical culture of companies, clubs and organizations we belong to.

What can government, business and/or society do to reduce these types of ethical scandals?

Business Ethics

The Idea of Business Ethics

The nature of ethics in business continues to evolve. It is understood that the more ethical the organization is, the better it is positioned for long-term success. It’s in the best interest of a company to operate ethically as trustworthy companies are better at attracting and keeping customers, talented employees, and capital. This long-term more “sustainable” and balanced model for business, allows business to grow in multiple ways. Today’s definitions of “ethical business” suggest that these organizations are more in tune with their key stakeholders, including customers, suppliers, local community, and even their physical environment. Multiple studies suggest that more ethical companies are also more profitable, benefiting their shareholders.[11]

The cases above remind us that organizations tainted by questionable ethics suffer from dwindling customer bases, employee turnover, and investor mistrust. Ethical troubles and shortfalls can also be expensive, and these kinds of expenses do not lead to innovation or growth. Expenses related to legal problems and marketing efforts to rebuild brand equity also take time and present a significant distraction to the organization.

Let’s begin this section by addressing this question: What can individuals, organizations, and government agencies do to foster an environment of ethical behavior in business? First, of course, we need to define the term.

What Is Ethics?

You probably already know what it means to be ethical: to know right from wrong and to know when you’re practicing one instead of the other. We can say that business ethics is the application of ethical behavior in a business context. Acting ethically in business means more than simply obeying applicable laws and regulations: It also means being honest, doing no harm to others, competing fairly, and declining to put your own interests above those of your company, its owners, and its workers. If you’re in business you obviously need a strong sense of what’s right and wrong. You need the personal conviction to do what’s right, even if it means doing something that’s difficult or personally disadvantageous.

Why Study Ethics?

Ideally, prison terms, heavy fines, and civil suits would discourage corporate misconduct, but, unfortunately, many experts suspect that this assumption is a bit optimistic. There are always people who think they can outsmart the system or believe that rules don’t apply to them. Again, we are reminded that ethical organizations are better positioned for long-term success. Whatever the condition of the ethical environment in the near future, one thing seems clear: the next generation entering business—which includes most of you—will find a world much different than the one that waited for the previous generation.

For example, cyberethics, user behavior and programmed computers may negatively impact people and society. In artificial intelligence (AI) programming decisions are built on assumptions in the code, so a programmer with a solid ethical foundation and awareness of how biases creep into code[12] will be more likely to develop more ethical decision-making tools through the technology being deployed. Recent history tells us in no uncertain terms that today’s business students, many of whom are tomorrow’s business leaders, need a much sharper understanding of the difference between what is and isn’t ethically acceptable.

As a business student, one of your key tasks is learning how to recognize and deal with the ethical challenges that will confront you. Yes, you will be confronted with an ethical situation that could potentially snowball if your ethical radar is not in tune. Ethical dilemmas often start small like stealing of office supplies and cheating on expense reports. Openness to ethical lapses over time can result in more egregious activities like financial coverups, sexual harassment, and other illegal offenses. Employers are increasingly seeking ethical role models to help create a more ideal business environment.

Identifying Ethical Issues and Dilemmas

Ethical issues are the difficult social questions that involve some level of controversy over what is the right thing to do. Environmental protection is an example of a commonly discussed ethical issue, because there can be trade offs between environmental and economic factors.

Ethical dilemmas are situations in which it is difficult for an individual to make decisions either because the right course of action is unclear or carries some potential negative consequences for the person or people involved.

Make no mistake about it: when you enter the business world, you’ll find yourself in situations in which you’ll have to choose the appropriate behavior. How, for example, would you answer questions like the following?

- Is it OK to accept a pair of sports tickets from a supplier?

- Can I buy office supplies from my brother-in-law?

- Is it appropriate to donate company funds to a local charity?

- If I find out that a friend is about to be fired, can I warn her?

Obviously, the types of situations are numerous and varied. Fortunately, we can break them down into a few basic categories: issues of honesty and integrity, conflicts of interest and loyalty, bribes versus gifts, theft, lying and deception, and whistleblowing. Let’s look a little more closely at each of these categories.

Addressing Ethical Dilemmas

An ethical dilemma is a morally problematic situation: you must choose between two or more acceptable but often opposing alternatives that are important to different groups. Experts often frame this type of situation as a “right-versus-right” decision. As indicated at the beginning of the chapter the additional challenges of time and pressure can make ethical dilemmas and even basic ethical issues more stressful and dangerous. It’s the sort of decision that Johnson & Johnson (known as J&J) CEO James Burke had to make in 1982. On September 30, twelve-year-old Mary Kellerman of Chicago died after her parents gave her Extra-Strength Tylenol. That same morning, 27-year-old Adam Janus, also of Chicago, died after taking Tylenol for minor chest pain. That night, when family members came to console his parents, Adam’s brother and his wife took Tylenol from the same bottle and died within 48 hours. Over the next two weeks, four more people in Chicago died after taking Tylenol. The actual connection between Tylenol and the series of deaths wasn’t made until an off-duty fireman realized from news reports that every victim had taken Tylenol. As consumers panicked, J&J pulled Tylenol off Chicago-area retail shelves. Researchers discovered Tylenol capsules containing large amounts of deadly cyanide. Because the poisoned bottles came from batches originating at different J&J plants, investigators determined that the tampering had occurred after the product had been shipped.[14]

So J&J wasn’t at fault. But CEO Burke was still faced with an extremely serious dilemma: Was it possible to respond to the tampering cases without destroying the reputation of a highly profitable brand?

Burke had two options:

- He could recall only the lots of Extra-Strength Tylenol that were found to be tainted with cyanide. In 1991, Perrier executives recalled only tainted product when they discovered that cases of their bottled water had been poisoned with benzine. This option favored J&J financially but possibly put more people at risk.

- Burke could order a nationwide recall—of all bottles of Extra-Strength Tylenol. This option would reverse the priority of the stakeholders, putting the safety of the public above stakeholders’ financial interests.

Burke opted to recall all 31 million bottles of Extra-Strength Tylenol on the market. The cost to J&J was $100 million, but public reaction was quite positive. Less than six weeks after the crisis began, Tylenol capsules were reintroduced in new tamper-resistant bottles, and by responding quickly and appropriately, J&J was eventually able to restore the Tylenol brand to its previous market position. When Burke was applauded for moral courage, he replied that he’d simply adhered to the long-standing J&J credo that put the interests of customers above those of other stakeholders. His only regret was that the perpetrator was never caught.[15]

If you’re wondering what your thought process should be if you’re confronted with an ethical dilemma, you might wish to remember the mental steps listed here—which happen to be the steps that James Burke took in addressing the Tylenol crisis:

- Define the problem. How to respond to the tampering case without destroying the reputation of the Tylenol brand.

- Identify feasible options. (1) Recall only the lots of Tylenol that were found to be tainted or (2) order a nationwide recall of all bottles of Extra-Strength Tylenol.

- Assess the effect of each option on stakeholders. Option 1 (recalling only the tainted lots of Tylenol) is cheaper but puts more people at risk. Option 2 (recalling all bottles of Extra-Strength Tylenol) puts the safety of the public above stakeholders’ financial interests.

- Establish criteria for determining the most appropriate action. Adhere to the J&J credo, which puts the interests of customers above those of other stakeholders.

- Select the best option based on the established criteria. In 1982, Option 2 was selected, and a nationwide recall of all bottles of Extra-Strength Tylenol was conducted.

Making Ethical Decisions

In contrast to the “right-versus-right” problem posed by an ethical dilemma, an ethical decision entails a “right-versus-wrong” decision—one in which there is clearly a right (ethical) choice and a wrong (unethical or illegal) choice. When you make a decision that’s unmistakably unethical or illegal, you’ve committed an ethical lapse. If you’re presented with this type of choice, asking yourself the questions in figure 4.2 will increase your odds of making an ethical decision.

To test the validity of this approach, let’s take a point-by-point look at Betty Vinson’s decisions:

- Her actions were clearly illegal.

- They were unfair to the workers who lost their jobs and to the investors who suffered financial losses (and also to her family, who shared her public embarrassment).

- She definitely felt badly about what she’d done.

- She was embarrassed to tell other people what she had done.

- Reports of her actions appeared in her local newspaper (and just about every other newspaper in the country).

So Vinson could have answered “yes” to all five of our test questions. To simplify matters, remember the following rule of thumb: If you answer yes to any one of these five questions, odds are that you’re about to do something you shouldn’t.

Revisiting Johnson & Johnson

As discussed earlier, Johnson & Johnson received tremendous praise for the actions taken by its CEO, James Burke, in response to the 1982 Tylenol catastrophe. However, things change. To learn how a company can destroy its good reputation, let’s fast forward to 2008 and revisit J&J and its credo, which states, “We believe our first responsibility is to the doctors, nurses and patients, to mothers and fathers and all others who use our products and services. In meeting their needs everything we do must be of high quality.”[16] How could a company whose employees believed so strongly in its credo find itself under criminal and congressional investigation for a series of recalls due to defective products?[17] In a three-year period, the company recalled 24 products, including Children’s, Infants’ and Adults’ Tylenol, Motrin, and Benadryl;[18] 1-Day Acuvue TruEye contact lenses sold outside the US;[19] and hip replacements.[20]

Unlike the Tylenol recall, no one had died from the defective products, but customers were certainly upset to find they had purchased over-the-counter medicines for themselves and their children that were potentially contaminated with dark particles or tiny specks of metal;[21] contact lenses that contained a type of acid that caused stinging or pain when inserted in the eye;[22] and defective hip implants that required patients to undergo a second hip replacement.[23]

Who bears the responsibility for these image-damaging blunders? Two individuals who were at least partially responsible were William Weldon, CEO, and Colleen Goggins, Worldwide Chairman of J&J’s Consumer Group. Weldon has been criticized for being largely invisible and publicly absent during the recalls. Additionally, he admitted that he did not understand the consumer division where many of the quality control problems originated. Goggins was in charge of the factories that produced many of the recalled products. She was heavily criticized by fellow employees for her excessive cost-cutting measures and her propensity to replace experienced scientists with new hires.[24] In addition, she was implicated in scheme to avoid publicly disclosing another J&J recall of a defective product.

After learning that J&J had released packets of Motrin that did not dissolve correctly, the company hired contractors to go into convenience stores and secretly buy up every pack of Motrin on the shelves. The instructions given to the contractors were the following: “You should simply ‘act’ like a regular customer while making these purchases. THERE MUST BE NO MENTION OF THIS BEING A RECALL OF THE PRODUCT!”[25] In May 2010, when Goggins appeared before a congressional committee investigating the “phantom recall,” she testified that she was not aware of the behavior of the contractors[26] and that she had “no knowledge of instructions to contractors involved in the phantom recall to not tell store employees what they were doing.” In her September 2010 testimony to the House Committee on Oversight and Government Reform, she acknowledged that the company in fact wrote those very instructions. In 2020, Johnson & Johnson is discontinuing their baby powder, one of their flagship products, because of the cancer-related issues found from the talc, an ingredient in the powder. This time, they are being proactive.[27]

Refusing to Rationalize

Despite all the good arguments in favor of doing the right thing, why do many reasonable people act unethically (at least at times)? Why do good people make bad choices? According to one study, there are four common rationalizations (excuses) for justifying misconduct:[28]

- My behavior isn’t really illegal or immoral. Rationalizers try to convince themselves that an action is OK if it isn’t downright illegal or blatantly immoral. They tend to operate in a gray area where there’s no clear evidence that the action is wrong.

- My action is in everyone’s best interests. Some rationalizers tell themselves: “I know I lied to make the deal, but it’ll bring in a lot of business and pay a lot of bills.” They convince themselves that they’re expected to act in a certain way.[29]

- No one will find out what I’ve done. Here, the self-questioning comes down to “If I didn’t get caught, did I really do it?” The answer is yes. There’s a simple way to avoid succumbing to this rationalization: Always act as if you’re being watched.

- The company will condone my action and protect me. This justification rests on a fallacy. Betty Vinson may honestly have believed that her actions were for the good of the company and that her boss would, therefore, accept full responsibility (as he promised). When she goes to jail, however, she’ll go on her own.

Here’s another rule of thumb: If you find yourself having to rationalize a decision, it’s probably a bad one.

Easy to Remember Ethical Tests to Help With Decision Making—What to do When the Light Turns Yellow

Ethical decision making can be difficult when balancing multiple stakeholder interests. It is compounded when there is added pressure and a lack of time for good analysis and review. There are a couple simple Ethical Strategies that can help with personal decision making or at least remind you to pump the brakes if needed.

- The Golden Rule – Treat others the way you expect to be treated.[30]

- The Grandma Rule – This is also called the Loved-one Rule. When balancing options, think about what an elder you respect may think of the options if you had to review it with them later.[31]

- The Sunshine Rule – This concept has been articulated in a number of ways. Think about how your plan may look in the light of day or on the front page of the newspaper. In this context it may be easier to consider if certain action is justified.[32]

- The Rule of the Big 4. When faced with a challenging situation or an option if you ask yourself these 4 questions it may help reveal if there is a linked ethical problem.[33]

- Is the decision HAZY? Are there elements to the issue that appear to be hidden or unclear? Do those items need to be revealed?

- Is the decision LAZY? Is the path forward or decision made with any effort? Is more work expected of you to make a good decision?

- Is the decision based on GREED? Who stands to gain by the decision? Is the decision being made for the good of the company and the stakeholders involved or is it based on personal greed?

- Is the decision made out of SPEED? Was there a rush to judgment without all of the facts?

What to Do When the Light Turns Yellow

Like our five questions, some ethical problems are fairly straightforward. Others, unfortunately, are more complicated, but it will help to think of our five-question test as a set of signals that will warn you that you’re facing a particularly tough decision—that you should think carefully about it and perhaps consult someone else. The situation is like approaching a traffic light. Red and green lights are easy; you know what they mean and exactly what to do. Yellow lights are trickier. Before you decide which pedal to hit, try posing our five questions. If you get a single yes, you will almost surely be better off hitting the brake.[34]

Issues of Honesty and Integrity

Master investor Warren Buffet once told a group of business students the following: “I cannot tell you that honesty is the best policy. I can’t tell you that if you behave with perfect honesty and integrity somebody somewhere won’t behave the other way and make more money. But honesty is a good policy. You’ll do fine, you’ll sleep well at night and you’ll feel good about the example you are setting for your coworkers and the other people who care about you.”[35]

If you work for a company that settles for its employees’ merely obeying the law and following a few internal regulations, you might think about moving on. If you’re being asked to deceive customers about the quality or value of your product, you’re in an ethically unhealthy environment.

Think About This Story:

“A chef put two frogs in a pot of warm soup water. The first frog smelled the onions, recognized the danger, and immediately jumped out. The second frog hesitated: The water felt good and he decided to stay and relax for a minute. After all, he could always jump out when things got too hot. As the water got hotter, however, the frog adapted to it, hardly noticing the change. Before long he was the main ingredient in frog-leg soup.”[36]

So, what’s the moral of the story? Don’t sit around in an ethically compromised environment and lose your integrity a little at a time; get out before the water gets too hot and your options have evaporated. Fortunately, a few rules of thumb can guide you. We’ve summed them up in figure 4.5.

Time and Pressure

The frog example reminds us that decision making while under pressure can be pretty important. Unfortunately, we will often be short on time when we are facing some decisions. This is why it is so important to arm ourselves with good ethical models and to know the value of good ethical decision making. If we can practice this decision making in the classroom or in situations when we are not under pressure or out of time, we can be more equipped for those times when time is not available. A common example is practicing a play in sports. In practice a team may walk through the ideal steps in slow motion and do it over and over, so they will be more prepared for the same play or sequence of events during the game when time is not a luxury.

The realities of time and pressure are so important and are another reason why we practice making deadlines in our coursework. We need to manage time well and be aware of when we procrastinate. In many ways procrastination can be thought of as a lid on that heated pot, creating more pressure, and potential disaster. Unfortunately, procrastination is not the only way we can contribute to a potentially unethical environment. We will review some additional challenges in the sections to follow.

Conflicts of Interest

Conflicts of interest occur when individuals must choose between taking actions that promote their personal interests over the interests of others or taking actions that don’t. A conflict can exist, for example, when an employee’s own interests interfere with, or have the potential to interfere with, the best interests of the company’s stakeholders (management, customers, and owners). Let’s say that you work for a company with a contract to cater events at your college and that your uncle owns a local bakery. Obviously, this situation could create a conflict of interest (or at least give the appearance of one—which is a problem in itself). When you’re called on to furnish desserts for a luncheon, you might be tempted to send some business your uncle’s way even if it’s not in the best interest of your employer. What should you do? You should disclose the connection to your boss, who can then arrange things so that your personal interests don’t conflict with the company’s.

The same principle holds that an employee shouldn’t use private information about an employer for personal financial benefit. Say that you learn from a coworker at your pharmaceutical company that one of its most profitable drugs will be pulled off the market because of dangerous side effects. The recall will severely hurt the company’s financial performance and cause its stock price to plummet. Before the news becomes public, you sell all the stock you own in the company. What you’ve done is called insider trading—acting on information that is not available to the general public, either by trading on it or providing it to others who trade on it. Insider trading is illegal, and you could go to jail for it.

Conflicts of Loyalty

You may one day find yourself in a bind between being loyal either to your employer or to a friend or family member. Perhaps you just learned that a coworker, a friend of yours, is about to be downsized out of his job. You also happen to know that he and his wife are getting ready to make a deposit on a house near the company headquarters. From a work standpoint, you know that you shouldn’t divulge the information. From a friendship standpoint, though, you feel it’s your duty to tell your friend. Wouldn’t he tell you if the situation were reversed? So what do you do? As tempting as it is to be loyal to your friend, you shouldn’t tell. As an employee, your primary responsibility is to your employer. You might be able to soften your dilemma by convincing a manager with the appropriate authority to tell your friend the bad news before he puts down his deposit.

Bribes vs. Gifts

It’s not uncommon in business to give and receive small gifts of appreciation, but when is a gift unacceptable? When is it really a bribe?

There’s often a fine line between a gift and a bribe. The following information may help in drawing it, because it raises key issues in determining how a gesture should be interpreted: the cost of the item, the timing of the gift, the type of gift, and the connection between the giver and the receiver. If you’re on the receiving end, it’s a good idea to refuse any item that’s overly generous or given for the purpose of influencing a decision. Because accepting even small gifts may violate company rules, always check on company policy.

Google’s “Code of Conduct,” for instance, has an entire section on avoiding conflicts of interest. They outline where these conflicts might occur, such as accepting gifts, personal investments, and outside employment, and provide guidelines: “In each of these situations, the rule is the same—if you are considering entering into a business situation that creates a conflict of interest, don’t. If you are in a business situation that may create a conflict of interest, or the appearance of a conflict of interest, review the situation with your manager and Ethics & Compliance.”[37]

Theft

The work environment is full of resources, materials, tools and assets. None of them are yours until, as a consumer, you purchase a resulting product. If you are able to keep this basic rule in mind you can check yourself and others when tempted by theft.

From a labor management perspective, we are focused on the loss of employee time. We can think of the “theft of time” as an issue in a few different ways. First, the traditional concern is how an employee may just post in accurate time on a time card or in a timekeeping system. In this case the employee posts a time beyond the hours worked in an effort to be paid for time not worked, resulting in stealing wages from the company for work not performed.

Another example of time theft to be considered is when employees are simply not following the tasks, duties or the job’s expectations but rather they are focused on doing other personal activities. Internet access and use of smartphones during working hours opens the door to this potential problem. In response, employers have employed a variety of types of monitoring technology to help with time management and supervision which allows the employer to have data for discussion during performance management meetings. While these monitoring practices may seem that there is a lack of trust, these types of practices can help to build trust as well. Employers have also had to re-evaluate job expectations, as a whole, and update job descriptions accordingly.

As a result of more employees working from home, a trend accelerated during the COVID pandemic, the ability to monitor employee time and activity became more complex. Many organizations were already facing a monitoring challenge, due to new technology in the workplace, but COVID then forced many organizations to make changes for which they were not fully prepared.

Historically, we would think of theft as the stealing of money, assets, or time from the company, but theft of information is a growing problem in our corporate climate. Data about customers, suppliers and the marketplace, has become more than just another tool for decision making. In many industries that same data has become a commodity, a commodity that is bought, sold, and in some cases stolen.

Lying and Deception

Unethical behavior in everyday life easily translates to the business environment. Lying is no exception. While similar to lying, deception is not the same thing. Deception can be thought of as the creation of something that does not exist. Deception may involve lying or some other form of misrepresentation. Deception could also simply be an act of providing less information than expected in an effort to mislead another party. Lying is saying things that are not true. Falsely assigning blame or inaccurately reporting conversations are examples of lying.[38]

If we make a practice of lying or deceiving others as a part of our job, we are misrepresenting the intentions of the company we represent. Not only is the relationship one’s employment at risk, in many cases, there are legal implications for organizations and individuals.

- An organization that misrepresents the safety of the work environment may soon find itself facing OSHA (Occupational Safety and Health Administration) penalties.

- An organization that misrepresents the quality of its products could face enforcement actions with the FDA (Food and Drug Administration).

- An organization that misrepresents financial reporting may find itself dealing with the SEC (Security and Exchange Commission).

Your Actions Matter—See Something, Say Something

Unethical activity in an organization can be unhealthy. It can easily spread and be deadly to the life of a company. It is important to know that unethical actions often start small and they grow when they are unchecked or not corrected. The goal of this chapter is to help you identify issues early so that you can work with your peers and management to correct the behavior and act as a better model for others. While often small issues can be managed, sometimes there are systemic organizational issues that demand more significant action.

Whistleblowing

As we’ve seen, the misdeeds of Betty Vinson and her accomplices at WorldCom didn’t go undetected. They caught the eye of Cynthia Cooper, the company’s director of internal auditing. Cooper, of course, could have looked the other way, but instead she summoned up the courage to be a whistleblower—an individual who exposes illegal or unethical behavior in an organization. Like Vinson, Cooper had majored in accounting at Mississippi State and was a hard-working, dedicated employee. Unlike Vinson, however, she refused to be bullied by her boss, CFO Scott Sullivan. In fact, she had tried to tell not only Sullivan but also auditors from the Arthur Andersen accounting firm that there was a problem with WorldCom’s books. The auditors dismissed her warnings, and when Sullivan angrily told her to drop the matter, she started cleaning out her office. But she didn’t relent. She and her team worked late each night, conducting an extensive, secret investigation. Two months later, Cooper had evidence to take to Sullivan, who told her once again to back off. Again, however, she stood up to him, and though she regretted the consequences for her WorldCom coworkers, she reported the scheme to the company’s board of directors. Within days, Sullivan was fired and the largest accounting fraud in history became public.[39]

As a result of Cooper’s actions, executives came clean about the company’s financial situation. The conspiracy of fraud was brought to an end, and though public disclosure of WorldCom’s problems resulted in massive stock-price declines and employee layoffs, investor and employee losses would have been greater without Cooper’s intervention. Even though Cooper did the right thing, and landed on the cover of Time magazine for it, the experience wasn’t exactly gratifying.

A lot of people applauded her action, but many coworkers shunned her; some even blamed her for the company’s troubles.[40]

Whistleblowing is sometimes career suicide. A survey of 200 whistleblowers conducted by the National Whistleblower Center found that half were fired for blowing the whistle.[41] Even those who keep their jobs can experience repercussions. As long as they stay, some will treat them (as one whistleblower put it) “like skunks at a picnic”; if they leave, they may be blackballed in the industry.[42] On a positive note, new Federal laws have been passed which are intended to protect whistleblowers.

For her own part, Cynthia Cooper doesn’t regret what she did. As she told a group of students at Mississippi State: “Strive to be persons of honor and integrity. Do not allow yourself to be pressured. Do what you know is right even if there may be a price to be paid.”[43] If your company tells employees to do whatever it takes, push the envelope, look the other way, and “be sure that we make our numbers,” you have three choices: go along with the policy, try to change things, or leave. If your personal integrity is part of the equation, you’re probably down to the last two choices.[44]

Legislative Action for Organizational Change

As part of the 2010 Dodd-Frank legislation passed by Congress in response to the 2008 financial crisis, the Securities and Exchange Commission (SEC) established a whistleblower-rewards program to provide employees and other individuals with the opportunity to report financial securities misconduct. According to a recent SEC report Fiscal year 2021 also was a record year for whistleblower awards, with the SEC awarding a total of $564 million to 108 whistleblowers. The whistleblower program also surpassed $1 billion in awards over the life of the program in financial penalties from companies that have done things to damage their own reputation as well as those of employees and other stakeholders.[45]

The whistleblower program is based on three key components: monetary awards, prohibition of employer retaliation, and protection of the whistleblower’s identity. The program requires the SEC to pay out monetary awards to eligible individuals who voluntarily provide original information about a violation of federal securities laws that has occurred, is ongoing, or is about to take place. The information supplied must lead to a successful enforcement action or monetary sanctions exceeding $1 million. No awards are paid out until the sanctions are collected from the offending firm.

A whistleblower must be an individual (not a company), and that individual does not need to be employed by a company to submit information about that specific organization. A typical award to a whistleblower is between 10 and 30 percent of the monetary sanctions the SEC and others (for example, the U.S. attorney general) are able to collect from the company in question.

Despite criticisms from some financial institutions, the whistleblower-rewards program continues to be a success—reinforcing the point that financial fraud will not go unnoticed by the SEC, employees, and others individuals.[46]

The SEC publishes statements and press releases on their website about decisions on their cases including the company charged and the settlement amounts.[47]

Government Changes Helped Introduce New Business Stakeholders

So far in this chapter we have discussed factors that have influenced ethical decision making within organizations. Over the past 100 years or so activities outside the organization have been a catalyst for change within the organization. As we walk through a very basic timeline of key events, we will see how national events and perceptions about business have changed, and led to a more ethical model for business which we have today.

The Rise of Government Intervention in Business

Ryan Engleman’s post, The Second Industrial Revolution, 1870-1914[48], describes societal changes, “The Second Revolution fueled the Gilded Age, a period of great extremes, great wealth and widespread poverty, great expansion and deep depression.”[49] By the end of the Great Depression in 1938, it was evident that something needed to be done to better compensate American workers.[50] President Franklin Delano Roosevelt’s administration passed the Fair Labor Standards Act in an attempt to give workers better working conditions and hours. Government stepped in to play a greater role in the relationship between worker and employer, and in doing so, a huge evolutionary step was taken. Government had become the first key stakeholder in American business, besides owners. Employees, then had become the second.

The Rise of the Consumer

In the 1960s a third key business stakeholder began to influence business in a more concerted way, the consumer. While it could be argued that consumers were the first stakeholder, prior to this time big business made goods they thought the consumer would want. Business did not seek out consumer preferences or feedback and consumers failed to leverage their collective influence. Henry Ford was famous for reflecting about consumer preferences of the Model T, “You can have it in any color, as long as it’s black.”[51]

Again like 1938, the government intervened and opened the door for action. Under President Kennedy the Consumer Bill of Rights was passed in 1960.[52] In 1965, Ralph Nader published his book Unsafe at Any Speed[53], further bolstering the need for greater consumer awareness and action towards business.[54] Consumer power has continued to grow and be more diversified with the advent of the internet.

Intervention in Business by Academia and Mass Media

The Civil Rights Act of 1964 ushered in the 1970s and a time of radical social change in the United States.[55] During this time large organizations of all kinds were questioned, including big government and big business. Academics also began to be more vocal. Nadar, Friedman, and others inserted academia and the media into the business stakeholder arena.[56],[57]

Over the next few decades business attempted to regulate itself until a series of scandals created the need for more government action. Enron, Worldcom, Wells-Fargo, VW, Ford and others faced huge scandals and Congress was forced to act again. In 2002 the Sarbanes Oxley Act (SOX) was passed to help develop more audit controls and transparency for business operations.[58]

Frameworks for Business Ethics

We will look at several ethics frameworks used by businesses, including: corporate social responsibility (CSR), environmental, social, and governance (ESG), and creating shared value (CSV).

Corporate Social Responsibility (CSR)

By the late 1900’s we can see how business was now positioning itself in the marketplace to interact with more outside stakeholders. Corporate social responsibility refers to the approach that an organization takes in balancing its responsibilities toward different stakeholders when making legal, economic, ethical, and social decisions. Remember that we previously defined stakeholders as those with a legitimate interest in the success or failure of the business and the policies it adopts. The term social responsibility refers to the approach that an organization takes in balancing its responsibilities toward their various stakeholders.

What motivates companies to be “socially responsible”? We hope it’s because they want to do the right thing, and for many companies, “doing the right thing” is a key motivator. The fact is, it’s often hard to figure out what the “right thing” is: what’s “right” for one group of stakeholders isn’t necessarily just as “right” for another. One thing, however, is certain: companies today are held to higher standards than ever before. Consumers and other groups consider not only the quality and price of a company’s products but also its character. If too many groups see a company as a poor corporate citizen, it will have a harder time attracting qualified employees, finding investors, and selling its products. Good corporate citizens, by contrast, are more successful in all these areas.

Environmental, Social, and Governance (ESG)

Environmental, social and governance is the second ethical business framework we will review. In this framework business acknowledges the additional influences of government and climate change. Business is no longer working in just a social context, there are also new rules to follow at all levels of the organization.

In the early 21st century there has also been a greater overall awareness about climate change. It is important to note that if we set aside the debate about climate change it is still clear that we are living in a world where there is greater competition for finite resources. Business needs a variety of resources, as raw material inputs. Business also often creates a variety of unwanted outputs in the production process, in the form of pollution. This management of resources has forced businesses to engage a variety of new stakeholders.

The internet and the electronic age of business has changed the business environment in more ways than one. Traditional and new kinds of business are able to reach a wider variety of people, as suppliers, customers and workers. This new diverse work environment has changed the way business looks at itself and it has challenged many traditional norms. Many businesses have had great success in developing a more diverse work environment and know that such change is key to attracting good talent.

Governance in this context is not limited to government oversight, even though government rules and regulations do play a role. A company’s board of directors (BOD) also play a key role in this organizational structure. The company’s board is often made up of key shareholders and stakeholders that are working to influence the organization and guide management. Organizations with a high level of governance will also have robust audit processes in place covering a myriad of activities from workplace safety and environmental impact to financial reporting integrity. Audit results are then passed on to the board for formal review and strategic decision making.

Many companies have grown to understand that the ideal balancing of environmental and social and governance influences can be a competitive advantage. Investors also see this as a possible benefit and therefore many seek companies with a strong ESG strategy.[59]

| Rank | Company | Actions towards reducing CO2 emissions |

|---|---|---|

| 1 | Alphabet | - Became carbon neutral in 2007 - By 2030 they pledge to become the first major company to operate full-time on carbon-free energy |

| 2 | Beyond Meat | - The Beyond Burger requires over 90% less land, 46% less energy, and produced 90% fewer greenhouse gas emissions compared to its cow counterpart |

| 3 | HP | - In 2019, HP eliminated power cord plastic ties and plastic document bags in its packaging - Launched the HP sustainable forest collaborative - By 2025 they plan to eliminate 75% of single-use plastic packaging |

| 4 | Unilever | By 2030, they plan to half their environmental footprint and become carbon negative |

| 5 | Johnson & Johnson | - In 2019, they received the Energy Star Partner of the Year Award - By 2025 all packaging will be 100% recyclable, reusable, or compostable - By 2050, facilities will be powered by 100% renewable energy |

| 6 | Tesla | - Has produced over 1 million electric cars, preventing close to 4 million tons of CO2 from entering the atmosphere - In 2018 and 2019, they provided disaster relief financial assistance for regions experiencing hurricanes and forest fires |

| 7 | Microsoft | - By 2025, company will shift to 100% renewable energy - By 2030, carbon negative - By 2050, remove all carbon that the company has been responsible for since its founding in 1975 |

| 8 | Apple | - All facilities are entirely carbon neutral - Company has invested $300 million in China CLean Energy Fund |

| 9 | Nike | - All North American operations are powered on 100% renewable energy, with goals of extending this across the globe by 2025 - Nike Grind program has recycled 30 million pairs of sports shoes into new apparel |

| 10 | Hasbro | - In 2019, they began using a plant-based plastic material made from agricultural byproducts - By 2022, they plan to remove almost all plastic from new plastic packaging - Launched TerraCycle, which allows used toys to be transformed into materials for constructing outdoor play spaces |

Figure 4.7: Top 10 publicly traded companies fighting climate change in 2022.

Although large companies are taking steps to reduce their carbon footprint, they are usually the biggest contributors to CO2 in the atmosphere. A hundred of the largest companies are responsible for around 71% of all global emissions. It is important that companies (like these in figure 4.7) continue to produce less waste, use renewable energy, source sustainable materials and labor, and reuse materials when possible. It is important to hold big companies accountable to their pledges for the future. While big companies can make the biggest impact by going carbon neutral, it is also important for smaller companies to find ways to lead as well. Both large and small companies are responsible for reducing their carbon footprint.[60]

Creating Shared Value (CSV)

Creating shared value is an aspirational viewpoint developed by Michael Porter and Mark Kramer.[61] This framework views business in an ideal position to solve big problems. Porter and Kramer summarize their work as follows:

“Shared value focuses companies on the right kind of profits—profits that create societal benefits rather than diminish them.”

In this model the great challenges or our time are viewed as opportunities and business is in an ideal position to meet those challenges. By having business focused on these issues it achieves a profit for its shareholders and it also solves problems, creating shared value.[62]

Figure 4.8 presents a model of corporate responsibility based on a company’s relationships with its stakeholders. In this model, the focus is on managers—not owners—as the principals involved in these relationships. Managers act as representatives of the business organization and those that must balance stakeholder influences as they manage the organization. Owners or shareholders are the stakeholders who invest risk capital in the firm in expectation of a financial return. Other stakeholders include employees, suppliers, and the communities in which the firm does business. Proponents of this model hold that customers, who provide the firm with revenue, have a special claim on managers’ attention. The arrows indicate the two-way nature of corporation-stakeholder relationships: All stakeholders have some claim on the firm’s resources and returns, and management’s job is to make decisions that balance these claims.[63]

Stakeholders of Business Ethics and Social Responsibility

Let’s look at some of the ways in which companies can be “ethically and socially responsible” in considering the claims of various stakeholders.

Owners

Owners or shareholders invest money in companies. In return, the people who run a company have a responsibility to increase the value of owners’ investments through profitable operations. In historical businesses of the early 1900’s ownership was more concentrated. Now, through the stock market, company ownership is more diverse, with some companies having thousands of “owners” through the company stock they own. Managers also have a responsibility to provide owners (as well as other stakeholders having financial interests, such as creditors and suppliers) with accurate, reliable information about the performance of the business. Clearly, this is one of the areas in which WorldCom managers fell down on the job. Upper-level management purposely deceived shareholders by presenting them with fraudulent financial statements

Managers

Managers have what is known as a fiduciary responsibility to owners: they’re responsible for safeguarding the company’s assets and handling its funds in a trustworthy manner. Yet managers experience what is called the agency problem; a situation in which their best interests do not align with those of the owners who employ them. To enforce managers’ fiduciary responsibilities for a firm’s financial statements and accounting records, the Sarbanes-Oxley Act of 2002 requires CEOs and CFOs to attest to their accuracy. The law also imposes penalties on corporate officers, auditors, board members, and any others who commit fraud. You’ll learn more about this law in your accounting and business law courses.

Employees

Companies are responsible for providing employees with safe, healthy places to work—as well as environments that are free from sexual harassment and all types of discrimination. They should also offer appropriate wages and benefits. In the following sections, we’ll take a closer look at these areas of corporate responsibility. The framework of corporate social responsibility (CSR) gives more weight to the interests of the employee, beyond basic safety and equality. In order to compete for good employees organizations need to consider personal fulfillment, individual creativity and flexibility as they think about the employee stakeholder. It is interesting to note that during the COVID pandemic of 2020-2022, even more resistant organizations were reminded that the concerted power of employees was compelling, often creating changes never imagined previously.

Wages and Benefits

At the very least, employers must obey laws governing minimum wage and overtime pay. A minimum wage is set by the federal government, though states can set their own rates as long as they are higher. As of 2022 the current federal rate, for example, is $7.25, while the rate in many states is far higher, with California at the extreme resting at $15.[64] By law, employers must also provide certain benefits—social security (retirement funds), unemployment insurance (protects against loss of income in case of job loss), and workers’ compensation (covers lost wages and medical costs in case of on-the-job injury). Most large companies pay most of their workers more than minimum wage and offer broader benefits, including medical, dental, and vision care, as well as savings programs, in order to compete for talent. Companies may also pay a living wage, which is a sufficient wage that covers the basic cost of living for a specific location.[65],[66]

Safety and Health

Though it seems obvious that companies should guard workers’ safety and health, some simply don’t. For over four decades, for example, executives at Johns Manville suppressed evidence that one of its products, asbestos, was responsible for the deadly lung disease developed by many of its workers.[67] The company concealed chest X-rays from stricken workers, and executives decided that it was simply cheaper to pay workers’ compensation claims than to create a safer work environment. A New Jersey court was quite blunt in its judgment: Johns Manville, it held, had made a deliberate, cold-blooded decision to do nothing to protect at-risk workers, in blatant disregard of their rights.[68]

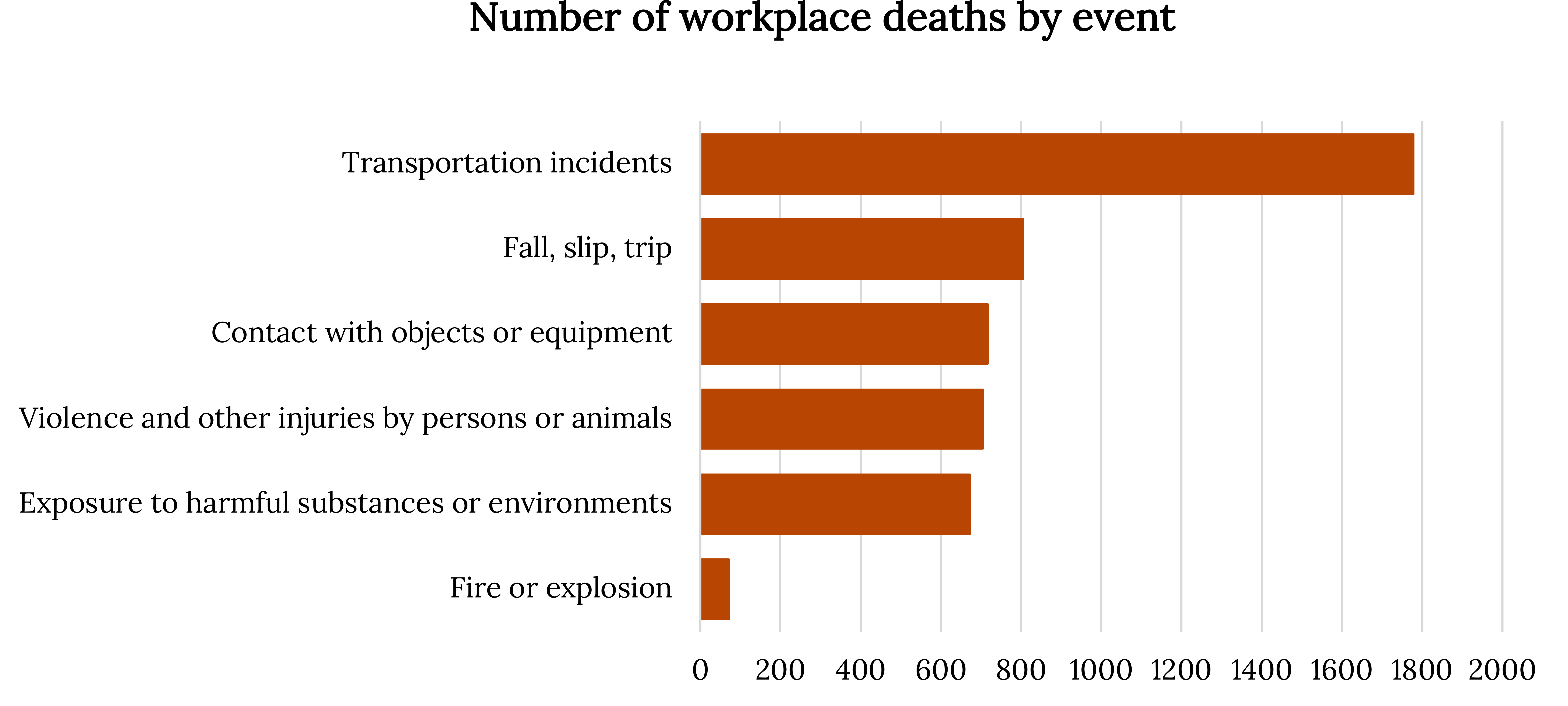

About four in 100,000 US workers die in workplace “incidents” each year. The Department of Labor categorizes deaths caused by conditions like those at Johns Manville as “exposure to harmful substances or environments.” How prevalent is this condition as a cause of workplace deaths? See figure 4.9, which breaks down workplace fatalities by cause. Some jobs are more dangerous than others. For a comparative overview based on workplace deaths by occupation, see figure 4.10.

| Occupation | % of total workplace deaths* |

|---|---|

| Transportation and material moving | 26.91% |

| Construction and extraction | 20.49% |

| Installation, maintenance, and repair | 8.25% |

| Management | 7.58% |

| Building and grounds cleaning and maintenance | 6.44% |

| Farming, fishing, and forestry | 5.54% |

| Protective service | 4.81% |

| Production | 4.70% |

| Sales and related | 4.20% |

| Food preparation and serving related | 1.72% |

Figure 4.10: Workplace deaths by occupation, 2020.

*Data is selective. The categories listed represent the ones with the highest percentage of total workplace deaths.

Fortunately for most people, things are far better than they were at Johns Manville. Procter & Gamble (P&G), for example, considers the safety and health of its employees paramount and promotes the attitude that “Nothing we do is worth getting hurt for.” With nearly 100,000 employees worldwide, P&G uses a measure of worker safety called “total incident rate per employee,” which records injuries resulting in loss of consciousness, time lost from work, medical transfer to another job, motion restriction, or medical treatment beyond first aid. The company attributes the low rate of such incidents—less than one incident per hundred employees—to a variety of programs to promote workplace safety.[69] During the COVID pandemic of 2020 new issues related to employee health created a greater sense of social awareness forcing change within and outside of the organization.

While our culture and the business environment continue to evolve and be more welcoming, problems continue to exist in the areas of sexual harassment and diversity. These issues can plague an organization at an individual level or at a more cultural level if individual action is not properly supported.

Prevention of Sexual Harassment

Sexual harassment occurs when an employee makes “unwelcome sexual advances, requests for sexual favors, and other verbal or physical conduct of a sexual nature” to another employee. It’s also considered sexual harassment when “submission to or rejection of this conduct explicitly or implicitly affects an individual’s employment, unreasonably interferes with an individual’s work performance or creates an intimidating, hostile or offensive work environment.”[70]

To prevent sexual harassment—or at least minimize its likelihood—a company should adopt a formal anti-harassment policy describing prohibited conduct, asserting its objections to the behavior, and detailing penalties for violating the policy.[71] Employers also have an obligation to investigate harassment complaints. Failure to enforce anti-harassment policies can be very costly. In 1998, for example, Mitsubishi paid $34 million to more than 350 female employees of its Normal, Illinois, plant to settle a sexual harassment case supported by the Equal Employment Opportunity Commission. The EEOC reprimanded the company for permitting an atmosphere of verbal and physical abuse against women, charging that female workers had been subjected to various forms of harassment, ranging from exposure to obscene graffiti and vulgar jokes to fondling and groping.[72] Since the “#MeToo” movement gained traction in late 2017, there has been widespread discussion regarding the best ways to prevent sexual harassment.[73]

Workforce Diversity

In addition to complying with equal employment opportunity laws, many companies make special efforts to recruit employees who are underrepresented in the workforce according to sex, race, gender, or some other characteristic. In helping to build more diverse workforces, such initiatives contribute to competitive advantage for two reasons:

- People from diverse backgrounds bring new talents and fresh perspectives to an organization, typically enhancing creativity in the development of new products.

- By more accurately reflecting the demographics of the marketplace, a diverse workforce improves a company’s ability to serve an ethnically diverse population.

- Again, the best companies see good ethics, including diversity, not as a final checklist of things they should do, but as part of an integrated strategy to create a competitive advantage.

Customers

The purpose of any business is to satisfy customers, who reward businesses by buying their products. Sellers are also responsible—both ethically and legally—for treating customers fairly. As indicated above, the voice and interests of customers as key stakeholders became more significant when the rights of consumers were first articulated by President John F. Kennedy in 1962.[74] He submitted to Congress a presidential message devoted to consumer issues.[75] Kennedy identified four consumer rights:

- The right to safe products. A company should sell no product that it suspects of being unsafe for buyers. Thus, producers have an obligation to safety-test products before releasing them for public consumption. The automobile industry, for example, conducts extensive safety testing before introducing new models (though recalls remain common).

- The right to be informed about a product. Sellers should furnish consumers with the product information that they need to make an in- formed purchase decision. That’s why pillows have labels identifying the materials used to make them, for instance.

- The right to choose what to buy. Consumers have a right to decide which products to purchase, and sellers should let them know what their options are. Pharmacists, for example, should tell patients when a prescription can be filled with a cheaper brand-name or generic drug. Telephone companies should explain alternative calling plans.

- The right to be heard. Companies must tell customers how to contact them with complaints or concerns. They should also listen and respond.

Companies share the responsibility for the legal and ethical treatment of consumers with several government agencies: the Federal Trade Commission (FTC), which enforces consumer-protection laws; the Food and Drug Administration (FDA), which oversees the labeling of food products; and the Consumer Product Safety Commission, which enforces laws protecting consumers from the risk of product-related injury.

Local Communities

For obvious reasons, most communities see getting a new business as an asset and view losing one—especially a large employer—as a detriment. After all, the economic impact of business activities on local communities is substantial: They provide jobs, pay taxes, and support local education, health, and recreation programs. Both big and small businesses donate funds to community projects, encourage employees to volunteer their time, and donate equipment and products for a variety of activities. The Amazon process to select a new second headquarters is an interesting example of how communities may actually compete for some additional business investment.[76] Larger companies can make greater financial contributions. Let’s start by taking a quick look at the philanthropic activities of a few US corporations.

Philanthropy

Many large corporations support various charities, an activity called philanthropy. Some donate a percentage of sales or profits to worthwhile causes. Other companies have more sophisticated strategies where philanthropy is actually integrated more with the overall corporate strategy and mission. Retailer Target, for example, donates 5 percent of its profits—about $2 million per week—to schools, neighborhoods, and local projects across the country; its store-based grants underwrite programs in early childhood education, the arts, and family-violence prevention.[77] The late actor Paul Newman donated 100 percent of the profits from “Newman’s Own” foods (salad dressing, pasta sauce, popcorn, and other products sold in eight countries). His company continues his legacy of donating all profits and distributing them to thousands of organizations, including the Hole in the Wall Gang camps for seriously ill children.[78]

For example, the LEGO Group consistently ranks as a top organization globally because of their commitment to Corporate Social Responsibility. According to their website in 2020, the LEGO Group has their commitment to sustainability broken into three categories: Children, Environment and People. Here are some examples of their specific CSR initiatives:

| Children | Environment | People |

|---|---|---|

| LEGO is partnered with Unicef to provide safeguards for children and support their wellbeing. | Pledged to implement sustainable packaging by 2025 | Through their local community engagement partnerships, LEGO provides opportunities for their employees to volunteer |

| Support children affected by crisis (e.g. natural disasters, armed conflict) | Pledged to make all core products from sustainable materials by 2030 | Pledged to build a diverse and inclusive organization |

Figure 4.11: LEGO Group commitment to corporate social responsibility (CSR).

Ethical Organizations

How Can You Recognize an Ethical Organization?

One goal of anyone engaged in business should be to foster ethical behavior in the organizational environment. How do we know when an organization is behaving ethically? Most lists of ethical organizational activities include the following criteria:

- Treat employees, customers, investors, and the public fairly.

- Hold every member personally accountable for his or her action.

- Communicate core values and principles to all members.

- Demand and reward integrity from all members in all situations.[79]

Employees at companies that consistently make 3BL Media’s annual list of the “100 Best Corporate Citizens” regard the items on the previous list as business as usual in the workplace. Companies at the top of the 2022 list include Owens Corning, PepsiCo, Inc, Apple Inc, HP Inc, and Cisco Systems, Inc..[80]

By contrast, employees with the following attitudes tend to suspect that their employers aren’t as ethical as they should be:

- They consistently feel uneasy about the work they do.

- They object to the way they’re treated.

- They’re uncomfortable about the way coworkers are treated.

- They question the appropriateness of management directives and policies.[81]

The Individual Approach to Ethics

Betty Vinson didn’t start out at WorldCom with the intention of going to jail. She undoubtedly knew what the right behavior was, but the bottom line is that she didn’t do it. How can you make sure that you do the right thing in the business world? How should you respond to the kinds of challenges that you’ll be facing? Because your actions in the business world will be strongly influenced by your moral character, let’s begin by assessing your current moral condition. Which of the following best applies to you (select one)?

- I’m always ethical.

- I’m mostly ethical.

- I’m somewhat ethical.

- I’m seldom ethical.

- I’m never ethical.

Now that you’ve placed yourself in one of these categories, here are some general observations. Few people put themselves below the second category. Most of us are ethical most of the time, and most people assign themselves to category number two—“I’m mostly ethical.” Why don’t more people claim that they’re always ethical?

Apparently, most people realize that being ethical all the time takes a great deal of moral energy. If you placed yourself in category number two, ask yourself this question: How can I change my behavior so that I can move up a notch? The answer to this question may be simple. Just ask yourself an easier question: How would I like to be treated in a given situation?[82]

Unfortunately, practicing this philosophy might be easier in your personal life than in the business world. Ethical challenges arise in business because companies, especially large ones, have multiple stakeholders who sometimes make competing demands. Making decisions that affect multiple stakeholders isn’t easy even for seasoned managers; and for new entrants to the business world, the task can be extremely daunting. You can, however, get a head start in learning how to make ethical decisions by looking at two types of challenges that you’ll encounter in the business world: ethical dilemmas and ethical decisions.

Chapter Video

Foxconn is a major supplier to Apple. All of its factories are in China and Taiwan, although it recently announced building a new one in the United States. Working conditions are much different than in a typical US factory. As you watch the video, think about what responsibilities Apple has in this situation. They don’t own Foxconn or its factories, yet their reputation can be nevertheless impacted.

To view this video, visit: https://youtu.be/Jk-xqPKOxl4?t=39

Key Takeaways

- Business ethics is the application of ethical behavior in a business context. Ethical (trustworthy) companies are better able to attract and keep customers, talented employees, and capital.

- Acting ethically in business means more than just obeying laws and regulations. It also means being honest, doing no harm to others, competing fairly, and declining to put your own interests above those of your employer and coworkers.

- In the business world, you’ll encounter conflicts of interest: situations in which you’ll have to choose between taking action that promotes your personal interest and action that favors the interest of others.

- Corporate social responsibility refers to the approach that an organization takes in balancing its responsibilities toward different stakeholders (owners, employees, customers, and the communities in which they conduct business) when making legal, economic, ethical, and social decisions.

- Managers have several responsibilities: to increase the value of owners’ investments through profitable operations, to provide owners and other stakeholders with accurate, reliable financial information, and to safeguard the company’s assets and handle its funds in a trustworthy manner.

- Companies have a responsibility to pay appropriate wages and benefits, treat all workers fairly, and provide equal opportunities for all employees. In addition, the must guard workers’ safety and health and to provide them with a work environment that’s free from sexual harassment.

- Consumers have certain legal rights: to use safe products, to be informed about products, to choose what to buy, and to be heard. Sellers must comply with these requirements.

- Businesspeople face two types of ethical challenges: ethical dilemmas and ethical decisions.

- An ethical dilemma is a morally problematic situation in which you must choose competing and often conflicting options which do not satisfy all stakeholders.

- An ethical decision is one in which there’s a right (ethical) choice and a wrong (unethical or downright illegal) choice.

References

Figures

Figure 4.1: Bernie Madoff’s mug shot. U.S. Department of Justice. 2009. Public domain. https://commons.wikimedia.org/wiki/File:BernardMadoff.jpg.

Figure 4.2: How to avoid an ethical lapse. Kindred Grey. 2022. CC BY 4.0. https://archive.org/details/4.6_20220714.

Figure 4.3: Caution light. Tom Barrett. 2021. Unsplash license. https://unsplash.com/photos/m8H0Ppm2IVk.

Figure 4.4: Two frogs and two different responses. Kindred Grey. 2022. CC BY 4.0. Added frog by GREY Perspective from Noun Project and from by

Ealancheliyan from Noun Project (Noun Project license). https://archive.org/details/frogs_20220714.

Figure 4.5: How to maintain honesty and integrity. Kindred Grey. 2022. CC BY 4.0. https://archive.org/details/4.2_20220714.

Figure 4.6: Overlap between government and stakeholders. Kindred Grey. 2022. CC BY 4.0. https://archive.org/details/timeline_202207.

Figure 4.7: Top 10 publicly traded companies fighting climate change in 2022. Adapted from https://www.leafscore.com/blog/top-10-publicly-traded-companies-fighting-climate-change-in-2021.

Figure 4.8: Management’s relationship with stakeholders. Kindred Grey. 2022. CC BY 4.0. Added house by Alex Muravev from Noun Project, city building by Graphiqu from Noun Project, people by kitzsingmaniiz from Noun Project, and businesswoman by Timothy Miller from Noun Project (Noun Project license). https://archive.org/details/4.3_20220714.

Figure 4.9: Workplace deaths by event or exposure (2020). Kindred Grey. 2022. CC BY 4.0. Data from https://www.bls.gov/news.release/pdf/cfoi.pdf (page 7). https://archive.org/details/4.4_20220714.

Figure 4.10: Workplace deaths by occupation, 2020. Data from https://www.bls.gov/news.release/pdf/cfoi.pdf (page 8).

Figure 4.11: LEGO Group commitment to corporate social responsibility (CSR). Information from https://www.lego.com/en-us/sustainability#:~:text=We%20are%20committed%20to%20protecting,all%20our%20boxes%20by%202025..

Video

Video 1: Foxconn: An Exclusive Inside Look. ABC News. 2012. Copyrighted. https://www.youtube.com/watch?v=Jk-xqPKOxl4&=&t=39s

- This case is based on Susan Pullman (2003). “How Following Orders Can Harm Your Career.” Wall Street Journal. Retrieved from: http://ww2.cfo.com/human-capital-careers/2003/10/how-following-orders-can-harm-your-career/ ↵

- Ibid. ↵

- Amanda Ripley (2002). “The Night Detective.” Time. Retrieved from: http://content.time.com/time/magazine/article/0,9171,1003990,00.html ↵

- Jeff Clabaugh (2005). “WorldCom’s Betty Vinson Gets 5 Months in Jail.” Washington Business Journal. Retrieved from: http://www.bizjournals.com/washington/stories/2005/08/01/daily51.html ↵

- Scott Reeves (2005). “Lies, Damned Lies and Scott Sullivan.” Forbes. Retrieved from: http://www.forbes.com/2005/02/17/cx_sr_0217ebbers.html; David A. Andelman (2005). “Scott Sullivan Gets Slap on the Wrist—WorldCom Rate Race.” Forbes. Retrieved from: http://www.mindfully.org/Industry/2005/Sullivan-WorldCom-Rat12aug05.htm ↵

- Susan Pullman (2003). “How Following Orders Can Harm Your Career.” Wall Street Journal. Retrieved from: http://ww2.cfo.com/human-capital-careers/2003/10/how-following-orders-can-harm-your-career/ ↵

- David Hancock (2002). “World-Class Scandal at WorldCom.” CBS News. Retrieved from: http://www.cbsnews.com/news/world-class-scandal-at-worldcom ↵

- Time (2009). “Top 10 Crooked CEO’s.” Retrieved from: http://content.time.com/time/specials/packages/article/0,28804,1903155_1903156_1903160,00.html ↵

- Fred Langan (2008). “The -billion BMIS Debacle: How a Ponzi Scheme Works.” CBC News. Retrieved from: http://www.cbc.ca/news/business/the-50-billion-bmis-debacle-how-a-ponzi-scheme-works-1.709409 ↵

- Ethan Wolff-Mann (2019). “Wells Fargo scandals: The complete list.” Yahoo! Finance. Retrieved from: https://finance.yahoo.com/news/wells-fargo-scandals-the-complete-timeline-141213414.html ↵

- Karpe, Alankar (2015) Being ethical is profitable. Project Management Institute: Newtown Square. and Karim, Khondkar; Suh, SangHyun, and Tang, Jiali (2016) Do ethical firms create value? Social Responsibility Journal v12 n1: 54-68 ↵

- Noble, Safiya Umoja (2018). Algorithms of Oppression: How Search Engines Reinforce Racism. NYU Press: New York. ↵

- Adrian Gostick and Dana Telford (2003). The Integrity Advantage. Salt Lake City: Gibbs Smith. pp. 3–4. ↵

- Tamara Kaplan (1998). “The Tylenol Crisis: How Effective Public Relations Saved Johnson & Johnson.” Aerobiological Engineering, Inc. Retrieved from: http://www.aerobiologicalengineering.com/wxk116/TylenolMurders/crisis.html ↵

- Ibid. ↵

- Yaakov Weber (1999). “CEO Saves Company’s Reputation, Products.” New Sunday Times. Retrieved from: https://web.archive.org/web/20030712124829/http:/adtimes.nstp.com.my/jobstory/jun13.htm ↵

- Ibid. ↵

- McNeil Consumer Healthcare (2011). “Product Recall Information.” Retrieved from: http://web.archive.org/web/20110808021741/http://www.mcneilproductrecall.com ↵

- Bill Berkrot (2010). “J&J Confirms Widely Expanded Contact Lens Recall.” Reuters. Retrieved from: http://www.reuters.com/article/us-jandj-recall-idUSTRE6B05G620101201 ↵

- Natasha Singer (2010). “Johnson & Johnson Recalls Hip Implants.” New York Times. Retrieved from: http://www.nytimes.com/2010/08/27/business/27hip.html ↵

- Mina Kimes (2010). “Why J&J’s Headache Won’t Go Away.” Fortune. Retrieved from: http://archive.fortune.com/2010/08/18/news/companies/jnj_drug_recalls.fortune/index.htm ↵

- Jonathan D. Rockoff and Jon Kamp (2010). “J&J Contact Lenses Recalled.” Wall Street Journal. Retrieved from: http://online.wsj.com/article/SB10001424052748703846604575447430303567108.html ↵

- Natasha Singer (2010). “Johnson & Johnson Recalls Hip Implants.” New York Times. Retrieved from: http://www.nytimes.com/2010/08/27/business/27hip.html ↵

- Mina Kimes (2010). “Why J&J’s Headache Won’t Go Away.” Fortune. Retrieved from: http://archive.fortune.com/2010/08/18/news/companies/jnj_drug_recalls.fortune/index.htm ↵

- ibid ↵

- Johnson and Johnson (2010). “Testimony of Ms. Colleen A. Goggins, Worldwide Chairman, Consumer Group, Johnson & Johnson, before the Committee on Oversight and Government Reform, U.S. House of Representatives.” Retrieved from: http://www.blogjnj.com/wp-content/uploads/2010/05/Testimony-of-Colleen-A-Goggins2.pdf ↵

- Jen Christensen (2020). "Johnson & Johnson will stop selling talc-based baby powder." CNN Health. Retrieved from: https://www.cnn.com/2020/05/20/health/johnson-and-johnson-stops-selling-talc-based-baby-powder-trnd/index.html ↵

- Saul W. Gellerman (2003). “Why ‘Good’ Managers Make Bad Ethical Choices” in Harvard Business Review on Corporate Ethics. Boston: Harvard Business School Press. p. 59. ↵

- Adrian Gostick and Dana Telford (2003). The Integrity Advantage. Salt Lake City: Gibbs Smith. p. 12. ↵