Chapter 2 The Foundations of Business

Learning Objectives

- Describe the concept of stakeholders and identify the stakeholder groups relevant to an organization.

- Discuss and be able to apply the PESTEL macro-business-environment model to an industry or emerging technology.

- Explain other key terms related to this chapter including entrepreneur, profit, and revenue.

Why Is Apple Successful?

In 1976 Steve Jobs and Steve Wozniak created their first computer, the Apple I.[1] They invested a mere $1,300 and set up business in Jobs’ garage. Three decades later, their business—Apple Inc.—has become one of the world’s most influential and successful companies. Jobs and Wozniak were successful entrepreneurs: those who take the risks and reap the rewards associated with starting a new business enterprise. Did you ever wonder why Apple flourished while so many other young companies failed? How did it grow from a garage start-up to a company generating over $260 billion in sales in 2019? How was it able to transform itself from a nearly bankrupt firm to a multinational corporation with locations all around the world? You might conclude that it was the company’s products, such as the Apple I and II, the Macintosh, or more recently its wildly popular iPod, iPhone, and iPad. Or, you could decide that it was its dedicated employees, management’s wiliness to take calculated risks, or just plain luck—that Apple simply was in the right place at the right time.

Before we draw any conclusions about what made Apple what it is today and what will propel it into a successful future, you might like to learn more about Steve Jobs, the company’s cofounder and former CEO. Jobs was instrumental in the original design of the Apple I and, after being ousted from his position with the company, returned to save the firm from destruction and lead it onto its current path. Growing up, Jobs had an interest in computers. He attended lectures at Hewlett-Packard after school and worked for the company during the summer months. He took a job at Atari after graduating from high school and saved his money to make a pilgrimage to India in search of spiritual enlightenment. Following his India trip, he attended Steve Wozniak’s “Homebrew Computer Club” meetings, where the idea for building a personal computer surfaced.[2] “Many colleagues describe Jobs as a brilliant man who could be a great motivator and positively charming. At the same time his drive for perfection was so strong that employees who did not meet his demands [were] faced with blistering verbal attacks.”[3] Not everyone at Apple appreciated Jobs’ brilliance and ability to motivate. Nor did they all go along with his willingness to do whatever it took to produce an innovative, attractive, high-quality product. So at age thirty, Jobs found himself ousted from Apple by John Sculley, whom Jobs himself had hired as president of the company several years earlier. It seems that Sculley wanted to cut costs and thought it would be easier to do so without Jobs around. Jobs sold $20 million of his stock and went on a two-month vacation to figure out what he would do for the rest of his life. His solution: start a new personal computer company called NextStep. In 1993, he was invited back to Apple (a good thing, because neither his new company nor Apple was doing well).

Steve Jobs was definitely not known for humility, but he was a visionary and had a right to be proud of his accomplishments. Some have commented that “Apple’s most successful days occurred with Steve Jobs at the helm.”[4]

Jobs did what many successful CEOs and managers do: he learned, adjusted, and improvised.[5] Perhaps the most important statement that can be made about him is this: He never gave up on the company that once turned its back on him. With Jobs being one of the most admired CEOs of all time, Tim Cook, Apple’s current CEO, had big shoes to fill when he took over from Jobs in 2011. Despite doubt from many, Apple has released popular products under Cook’s leadership, such as the Apple Watch and AirPods, with Apple worth approximately $2 trillion as of 2020.

Introduction

As the story of Apple suggests, today is an interesting time to study business. Advances in technology are bringing rapid changes in the ways we produce and deliver goods and services. The Internet and other improvements in communication, such as smartphones, video conferencing, and social networking, now affect the way we do business. Companies are expanding international operations, and the workforce is more diverse than ever. Corporations are being held responsible for the behavior of their executives, and more people share the opinion that companies should be good corporate citizens. Because of the role they played in the worst financial crisis since the Great Depression, businesses today face increasing scrutiny and negative public sentiment.[6]

Economic turmoil that began in the housing and mortgage industries as a result of troubled subprime mortgages quickly spread to the rest of the economy. In 2008, credit markets froze up and banks stopped making loans. Lawmakers tried to get money flowing again by passing a $700 billion Wall Street bailout, however now-cautious banks became reluctant to extend credit. Without money or credit, consumer confidence in the economy dropped and consumers cut back on spending. Unemployment rose as troubled companies shed the most jobs in five years, and 760,000 Americans marched to the unemployment lines.[7] The stock market reacted to the financial crisis and its stock prices dropped by 44 percent while millions of Americans watched in shock as their savings and retirement accounts took a nosedive. In fall 2008, even Apple, a company that had enjoyed strong sales growth over the past five years, began to cut production of its popular iPhone. Without jobs or cash, consumers would no longer flock to Apple’s fancy retail stores or buy a prized iPhone.[8] Apple eventually recovered and continued to grow, reaching an all time high stock price of $325 in February 2020. However, Apple then faced economic turmoil yet again with the COVID-19 pandemic causing its stock prices to plummet almost 30% to $224. By June 2020, Apple had rebounded from this, reaching a new record stock price of $362.[9]

As you go through the course with the aid of this text, you’ll explore the exciting world of business. We’ll introduce you to the various activities in which business people engage—accounting, finance, information technology, management, marketing, and operations. We’ll help you understand the roles that these activities play in an organization, and we’ll show you how they work together. We hope that by exposing you to the things that businesspeople do, we’ll help you decide whether business is right for you and, if so, what areas of business you’d like to study further.

Getting Down to Business

A business is any activity that provides goods or services to consumers for the purpose of making a profit. Be careful not to confuse the terms revenue and profit. Revenue represents the funds an enterprise receives in exchange for its goods or services. Profit is what’s left (hopefully) after all the bills are paid. When Steve Jobs and Steve Wozniak launched the Apple I, they created the Apple Computer in Jobs’ family garage in the hope of making a profit. Before we go on, let’s make a couple of important distinctions concerning the terms in our definitions. First, whereas Apple produces and sells goods (Mac, iPhone, iPod, iPad, Apple Watch), many businesses provide services. Your bank is a service company, as is your Internet provider. Hotels, airlines, law firms, movie theaters, and hospitals are also service companies. Many companies provide both goods and services. For example, your local car dealership sells goods (cars) and also provides services (automobile repairs). Second, some organizations are not set up to make profits. Many are established to provide social or educational services. Such not-for-profit (or nonprofit) organizations include the United Way of America, Habitat for Humanity, the Boys and Girls Clubs, the Sierra Club, the American Red Cross, and many colleges and universities. Most of these organizations, however, function in much the same way as a business. They establish goals and work to meet them in an effective, efficient manner. Thus, most of the business principles introduced in this text also apply to nonprofits.

Business Participants and Activities

Let’s begin our discussion of business by identifying the main participants of business and the functions that most businesses perform. Then we’ll finish this section by discussing the external factors that influence a business’ activities.

Participants

Every business must have one or more owners whose primary role is to invest money in the business. When a business is being started, it’s generally the owners who polish the business idea and bring together the resources (money and people) needed to turn the idea into a business. The owners also hire employees to work for the company and help it reach its goals. Owners and employees depend on a third group of participants—customers. Ultimately, the goal of any business is to satisfy the needs of its customers in order to generate a profit for the owners.

Stakeholders

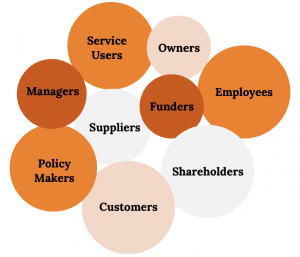

Consider your favorite restaurant. It may be an outlet or franchise of a national chain (more on franchises in a later chapter) or a local “mom and pop” without affiliation to a larger entity. Whether national or local, every business has stakeholders—those with a legitimate interest in the success or failure of the business and the policies it adopts. Stakeholders include customers, vendors, employees, landlords, bankers, and others (see Figure 2.2). All have a keen interest in how the business operates, in most cases for obvious reasons. If the business fails, employees will need new jobs, vendors will need new customers, and banks may have to write off loans they made to the business. Stakeholders do not always see things the same way—their interests sometimes conflict with each other. For example, lenders are more likely to appreciate high profit margins that ensure the loans they made will be repaid, while customers would probably appreciate the lowest possible prices. Pleasing stakeholders can be a real balancing act for any company.

Functional Areas of Business

The activities needed to operate a business can be divided into a number of functional areas. Examples include: management, operations, marketing, accounting, and finance. Let’s briefly explore each of these areas.

Management

Managers are responsible for the work performance of other people. Management involves planning for, organizing, leading, and controlling a company’s resources so that it can achieve its goals. Managers plan by setting goals and developing strategies for achieving them. They organize activities and resources to ensure that company goals are met and staff the organization with qualified employees and managers lead them to accomplish organizational goals. Finally, managers design controls for assessing the success of plans and decisions and take corrective action when needed.

Operations

All companies must convert resources (labor, materials, money, information, and so forth) into goods or services. Some companies, such as Apple, convert resources into tangible products—Macs, iPhones, Apple Watch, etc. Others, such as hospitals, convert resources into intangible products—e.g., health care. The person who designs and oversees the transformation of resources into goods or services is called an operations manager. This individual is also responsible for ensuring that products are of high quality.

Marketing

Marketing consists of everything that a company does to identify customers’ needs (i.e., market research) and design products to meet those needs. Marketers develop the benefits and features of products, including price and quality. They also decide on the best method of delivering products and the best means of promoting them to attract and keep customers. They manage relationships with customers and make them aware of the organization’s desire and ability to satisfy their needs.

Accounting

Managers need accurate, relevant and timely financial information, which is provided by accountants. Accountants measure, summarize, and communicate financial and managerial information and advise other managers on financial matters. There are two fields of accounting. Financial accountants prepare financial statements to help users, both inside and outside the organization, assess the financial strength of the company. Managerial accountants prepare information, such as reports on the cost of materials used in the production process, for internal use only.

Finance

Finance involves planning for, obtaining, and managing a company’s funds. Financial managers address questions such as the following: How much money does the company need? How and where will it get the necessary money? How and when will it pay the money back? What investments should be made in plant and equipment? How much should be spent on research and development? Good financial management is particularly important when a company is first formed, because new business owners usually need to borrow money to get started.

External Forces That Influence Business Activities

Apple and other businesses don’t operate in a vacuum; they’re influenced by a number of external factors. These include the economy, government, consumer trends, technological developments, public pressure to act as good corporate citizens, and other factors. Collectively, these forces constitute what is known as the “macro-environment”—essentially the big picture world external to a company over which the business exerts very little if any control. Figure 2.3 sums up the relationship between a business and the outside forces that influence its activities. One industry that’s clearly affected by all these factors is the fast-food industry. Companies such as Taco Bell, McDonald’s, Cook-Out and others all compete in this industry. A strong economy means people have more money to eat out. Food standards are monitored by a government agency, the Food and Drug Administration. Preferences for certain types of foods are influenced by consumer trends, for example, fast food companies are being pressured to make their menus healthier. Finally, a number of decisions made by the industry result from its desire to be a good corporate citizen. For example, several fast-food chains have responded to environmental concerns by eliminating Styrofoam containers.[10]

Of course, all industries are impacted by external factors, not just the food industry. As people have become more conscious of the environment, they have begun to choose new technologies, like all-electric cars to replace those that burn fossil fuels. Both established companies, like Nissan with its Nissan Leaf, and brand new companies like Tesla have entered the market for all-electric vehicles. While the market is still small, it is expected to grow at a compound annual growth rate of 21.1 percent between 2019 and 2030.[11]

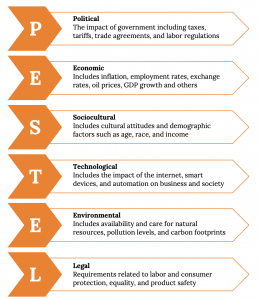

PESTEL Analysis

One useful tool for analyzing the external environment in which an industry or company operates is the PESTEL model. PESTEL is an acronym, with each of the letters representing an aspect of the macro-environment that a business needs to consider in its planning. Let’s briefly run through the meaning of each letter.

P stands for the political environment. Governments influence the environment in which businesses operate in many ways, including taxation, tariffs, trade agreements, labor regulations, and environmental regulations.

E represents the economic environment. As we will see in detail in a later chapter, whether the economy is growing or not is a major concern to business. Numerous economic indicators have been created for the specific purpose of measuring the health of the economy.

S indicates the sociocultural environment, which is a category that captures societal attitudes, trends in national demographics, and even fashion trends. The term demographics applies to any attribute that can be used to describe people, such as age, income level, gender, race, and so on. As a society’s attitudes or its demographics change, the market for goods and services can shift right along with it.

T is for technological factors. In the last several decades, perhaps no force has impacted business more than the emergence of the internet. Nearly instantaneous access to information, e-commerce, social media, and even the ability to control physical devices from remote locations have all come about due to technological forces.

The second E stands for environmental forces, which in this case means natural resources, pollution levels, recycling, etc. While the attitudes of a society towards the natural environment would be considered a sociocultural force, the level of pollution, the supply of oil, etc. would be grouped under this second E for environment.

Finally, the L represents legal factors. These forces often coincide with the political factors already discussed, because it is politicians (i.e., government) that enacts laws. However, there are other legal factors that can impact businesses as well, such as decisions made by courts that may have broad implications beyond the case being decided.

When conducting PESTEL analysis, it is important to remember that there can be considerable overlap from category to category. It’s more important that businesses use the model to thoroughly assess its external environment, and much less important that they get all the forces covered under the “right” category. It is also important to remember that an individual force, in itself, is not inherently positive or negative but rather presents either an opportunity or a threat to different businesses. For example, societal attitudes moving in favor of green energy are an opportunity for those with capabilities in wind, solar, and other renewables, while presenting a threat, or at least a need to change, to companies whose business models depend exclusively on fossil fuels.

As you read through the description of the PESTEL model, it may have occurred to you to ask, “Where would COVID-19 fit in using this model?” since this pandemic had a major impact on all sorts of businesses and on every economy in the world. In other models that analyze the macro-environment, there is a force called “Natural” that essentially equates to the environmental force in the PESTEL model. So, the natural environment is usually equated to the forces described above, like natural resources and pollution, but a broader view of this force would logically include something like a pandemic. And consistent with other types of forces, COVID-19 has been hugely unfavorable to some industries and yet a boost to business for others. Any business in the realm of tourism has probably suffered large revenue losses and employee layoffs and furloughs, while makers of personal protective equipment (PPE)[12] have been challenged just to meet the increase in demand.13

Chapter Video

This video covers the six macro-environmental forces that make up the PESTEL model.

(Copyrighted material)

Key Takeaways

- The main participants in a business are its owners, employees, and customers.

- Every business must consider its stakeholders, and their sometimes conflicting interests, when making decisions.

- The activities needed to run a business can be divided into functional areas. The business functions correspond fairly closely with many majors found within a typical college of business.

- Businesses are influenced by such external factors as the economy, government, and other forces external to the business. The PESTEL model is a useful tool for analyzing these forces.

Image Credits: Chapter 2

Figure 2.1: “Steve Jobs.” (2011). Flickr. CC BY 2.0. Retrieved from: https://www.flickr.com/photos/8010717@N02/6216457030

Video Credits: Chapter 2

Alyssa Duong (2019). “The PESTEL Model.” VTech Works. Retrieved from: https://vtechworks.lib.vt.edu/handle/10919/88014

- This vignette is based on an honors thesis written by Danielle M. Testa (2007). “Apple, Inc.: An Analysis of the Firm’s Tumultuous History, in Conjunction with the Abounding Future.” Lehigh University. ↵

- Lee Angelelli (1994). “Steve Paul Jobs.” Retrieved from: http://ei.cs.vt.edu/~history/Jobs.html ↵

- Ibid. ↵

- Cyrus Farivar (2006). “Apple’s first 30 years; three decades of contributions to the computerIndustry.” Macworld. p. 2. ↵

- Dan Barkin (2006). “He made the iPod: How Steve Jobs of Apple created the new millennium’s signature invention.” Knight Ridder Tribune Business News. p. 1. ↵

- Jon Hilsenrath, Serena Ng, and Damian Paletta (2008). “Worst Crisis Since ’30s, With No End Yet in Sight.” Wall Street Journal, Markets. Retrieved from: http://www.wsj.com/articles/SB122169431617549947 ↵

- Steve Hargreaves (2008). “How the Economy Stole the Election.” CNN.com. Retrieved from: http://money.cnn.com/galleries/2008/news/0810/gallery.economy_election/index.html ↵

- Dan Gallagher (2008). “Analyst Says Apple Is Cutting Back Production as Economy Weakens.” MarketWatch. Retrieved from: http://www.marketwatch.com/story/apple-cutting-back-iphone-production-analyst-says?amp;dist=msr_1 ↵

- Shawn Tully (2020). "After Apple's Stratospheric Rise, Investors are Facing a New Threat: Simple Math." Fortune. Retrieved from https://fortune.com/2020/06/30/apple-stock-aapl-shares-whats-next-coronavirus-pandemic-covid-19-nasdaq ↵

- David Baron (2003). “Facing-Off in Public.” Stanford Business. pp. 20-24. Retrieved from: https://www.gsb.stanford.edu/sites/gsb/files/2003August.pdf ↵

- Markets and Markets (2018). "Electric Vehicle Market by Vehicle, Vehicle Class, Propulsion, EV Sales, Charging Station & Region - Global Forecast to 2030." Retrieved from: https://www.marketsandmarkets.com/Market-Reports/electric-vehicle-market-209371461.html ↵

- Kate Rogers and Betsy Spring (2020). “Personal Protective Equipment Is in High Demand as Coronavirus Spreads.” CNBC. Retrieved from: https://www.cnbc.com/2020/03/06/personal-protective-equipment-is-in-high-demand-as-coronavirus-spreads.html13 Taylor Borden and Allana Akhtar (2020). “The Coronavirus Outbreak Has Triggered Unprecedented Mass Layoffs and Furloughs. Here Are the Major companies That Have Announced They Are Downsizing Their Workforces.” Business Insider. Retrieved from: https://www.businessinsider.com/coronavirus-layoffs-furloughs-hospitality-service-travel-unemployment-2020#airbnb-announced-it-is-laying-off-about-25-of-its-workforce-or-1900-employees-on-may-5-its-severance-package-includes-several-months-pay-a-year-of-healthcare-and-support-finding-a-new-job-2 ↵