4. Analyze the External Environment

After engaging with this chapter, you will understand and be able to apply the following concepts.

- The external environment of a company

- The structure of the external environment

- The general environment of an organization

- The industry environment of a company

- The competitive environment of a firm

- The role of external analysis in case analysis

You will be equipped to analyze a firm’s

- Industry, market, and market segment

- General environment using the PESTEL analysis instrument

- Industry environment using the Porter’s Five Forces analysis instrument

- Competitive environment using the strategic group mapping analysis instrument

4.1 Introduction

As you have learned, strategic management and case analysis follow a structured process through strategic analysis, strategy formulation, and strategy implementation. Case analysis begins with analyzing a company’s organizational performance, which you learned in Chapter 3.

In this chapter, you learn the strategic management concepts and theories and the analytical frameworks and tools that support strategically analyzing a firm’s external environment. This includes understanding what is included in a firm’s external environment and how the environment is structured. You learn how to analyze the general environment, the industry environment, and the competitive environment. You also learn the role of external analysis in case analysis, as analyzing the external environment of a company provides a critical outside-in perspective and helps companies to determine attractive markets in which to operate.

4.2 The External Environment

Before you can analyze the external environment of a company, you must first know what makes up the external environment and why analyzing it is important. All organizations operate in an external environment. The external environment includes everything outside a company that influences its ability to create and sustain a competitive advantage. The forces, factors, and actions of competitors that operate in a firm’s external environment are all outside the direct control of a firm.

Understanding a firm’s external environment is crucial because it is a source of opportunities that can be harnessed to support a firm’s competitive advantage. The external environment is also a source of threats that must be mitigated to ensure continued company success.

The external environment includes everything outside a company that influences its ability to create and sustain a competitive advantage. The forces, factors, and actions of competitors that operate in a firm’s external environment are all outside the direct control of a firm. The external environment is a source of opportunities that can be harvested to support a firm’s competitive advantage and threats that must be mitigated to ensure continued company success.

4.3 The Structure of the External Environment

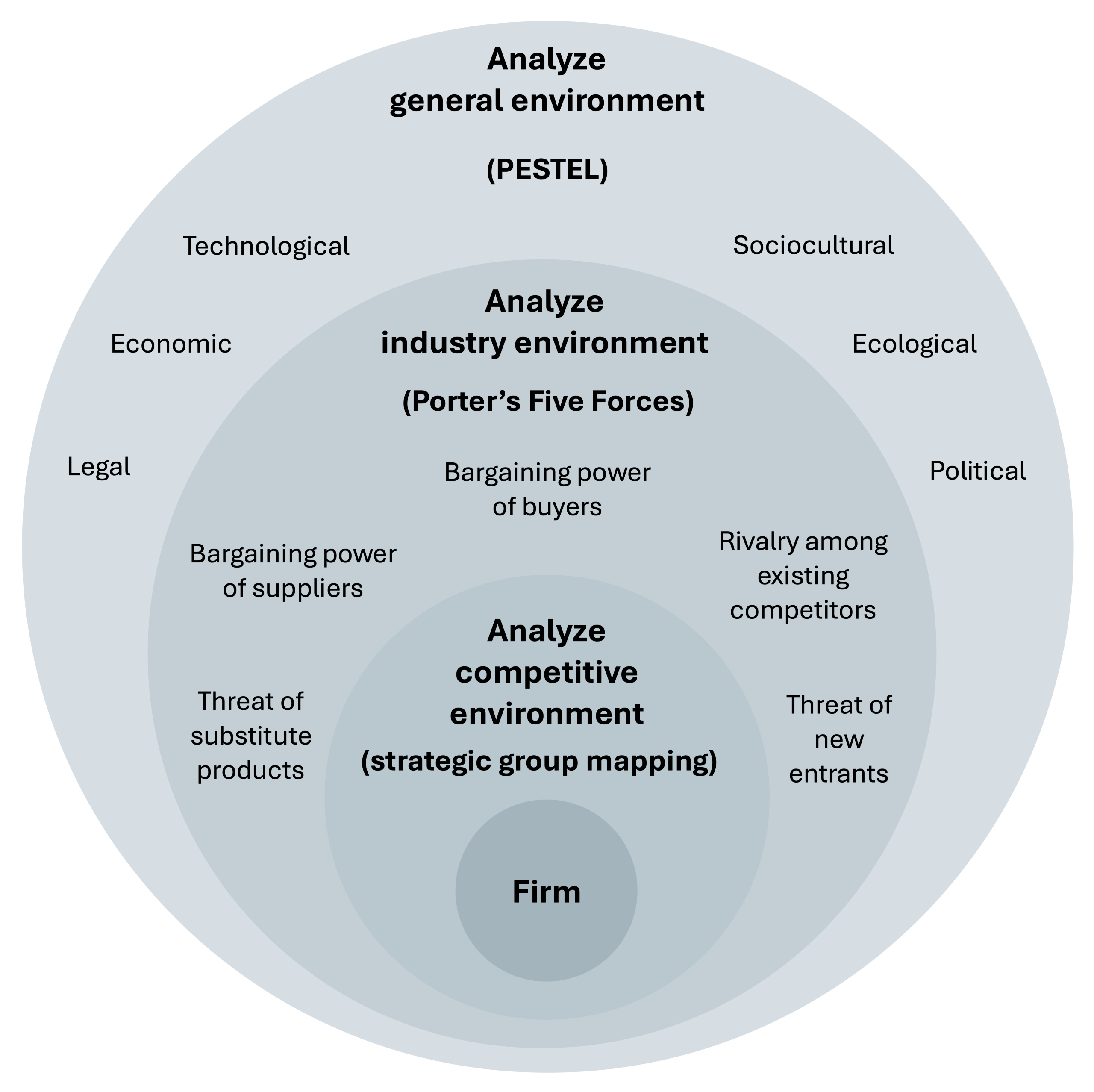

In strategic management, the structure of a firm’s external environment consists of the general environment, the industry environment, and the competitive environment. This section introduces analytical instruments you use to support your analysis of each of these elements.

The General Environment

The first and broadest level of a firm’s external environment is the general environment (also known as the macro environment). The general environment consists of the societal events and trends that impact all firms in an industry, including political, economic, sociocultural, technological, environmental, and legal factors. The PESTEL framework is the strategic management framework used to analyze the general environment. The factors in an organization’s general environment are the furthest away from the firm in origin, and the firm has the least influence over these factors.

The Industry Environment

The second level of the external environment is the industry environment, and it is narrower in focus. Sometimes the industry environment is referred to as the task environment. A firm’s industry environment consists of the forces that exert influence and pressure over the firm’s entire industry. To assess the market attractiveness and profit potential of the industry, you use a Porter’s Five Forces analysis instrument to analyze the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products, the threat of new entrants, and the rivalry among existing competitors. In contrast to the factors in the general environment, the forces and dimensions in an organization’s industry environment are closer in proximity to the firm, and the firm has more influence over these forces.

The Competitive Environment

The third level of the external environment is the competitive environment, and it is the narrowest in focus, consisting of companies that pursue similar strategies in the same industry—strategic groups. A firm has the most influence over the dynamic influences in its competitive environment.

The external environment consists of the general environment, the industry environment, and the competitive environment. The first and broadest level of a firm’s external environment is the general environment, which consists of the societal events and trends that impact all firms in an industry, including political, economic, sociocultural, technological, environmental, and legal factors. The PESTEL framework is the strategic management framework used to analyze the general environment. The second level of the external environment is the industry environment, which is narrower in focus and consists of the forces that exert influence and pressure over the firm’s entire industry: the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products, the threat of new entrants, and the rivalry among existing competitors. Porter’s Five Forces framework is the strategic management tool used to analyze the industry environment. The third level of the external environment is the competitive environment, which is the narrowest in focus and consist of companies that pursue similar strategies in the same industry.

Bibliography

Beata, B., Adrian, N., Tunde, K., & Hajnalka, M. (2020). Methodology of the external environmental analysis as a part of strategy planning. Annals of the University of Oradea, Economic Science Series, 29, 461–466.

4.4 Define the Industry, Market, and Market Segment

Before you can analyze a firm’s external environment, you must determine the firm’s industry, its market, and the market segment it is focusing on. A firm’s industry, market, and market segments play a crucial role in shaping strategy and performance. Industry is a group of organizations, businesses, companies, or firms that compete in the marketplace for profit, engaging in similar business activities and producing or selling similar products or services. A market refers to the overall pool of potential customers for a product or service within a specific industry, and a market segment is a distinct group within a market that is identified by shared characteristics like demographics, needs, or behaviors.

Companies in an industry are related in their main activities (the activities that generate the most revenue for the firm). For example, many companies finance their products. Automakers finance automobiles, and technology firms finance new technology products. Finance is an important business support unit for the company and one that new business graduates may join and manage. However, finance is not the main activity of either an automaker or a technology firm, so neither belongs to the finance industry. Automakers are members of the auto industry, and technology firms are members of the technology industry.

It is important to consider industry and competitor analysis when considering the company’s positioning and performance. Let’s consider Chipotle.

Chipotle is considered to be in the food service industry, which places it alongside all types of restaurants, from other fast-food restaurants, such as McDonald’s, to exclusive restaurants and even institutional cafeterias, such as those found on university campuses, and catering services. Although it is accurate that Chipotle is in the food service business, this is not a useful industry to consider for most analyses of Chipotle. The restaurant industry is another possibility. This includes all types of restaurants, from other fast-food restaurants, such as Kentucky Fried Chicken, to exclusive restaurants, such as Ruth’s Chris Steak House. This is likely still too broad to be helpful in analyzing Chipotle. Considering restaurants that serve Mexican food is another potential perspective. This would include food trucks and local Mexican restaurants. Again, this is likely too broad.

A more pragmatic and useful approach is to consider what other restaurants Chipotle directly competes against. Additional choices still need to be made to determine Chipotle’s direct competitors. A competitor is a business within the same industry that offers similar products or services and competes for customers.

Competitors selling products that customers tend to buy one at a time may compete for the same customer, with only one competitor winning. This applies to products that garner high brand loyalty from customers. This happens in different circumstances, such as when competitors sell products that are expensive relative to their customer’s ability and willingness to pay. For example, for many buyers, a vehicle is a major purchase, and many customers have high brand loyalty to vehicle makers. Many customers buy only one vehicle at a time. In this case, one competitor wins the sale of the vehicle. Phones, being less expensive than vehicles, are typically purchased more frequently by customers, but they still tend to show strong brand loyalty to manufacturers. Again, only one competitor wins.

When businesses sell products or services that are less expensive relative to their customer’s ability and willingness to pay, a company is competing for customers at each decision point and each point of sale. This is especially true for consumable goods, such as food. In the case of eating at fast-food restaurants, although many customers have brand loyalty, many customers eat at multiple fast-food restaurants.

This complicates the identification of Chipotle’s industry, market, and market segment. Chipotle’s direct competitors could include all fast-food restaurants. On the other hand, Chipotle could be seen as competing directly with Mexican fast-food restaurants. Additional competitors could be restaurants that focus on fresh ingredients or Mexican grills that serve fresh food. All of these are competitors, to varying degrees.

Chipotle’s most direct competitors include Qdoba Mexican Eats, Moe’s Southwest Grill, Baja Fresh Mexican Grill, and Rubio’s Coastal Grill. Chipotle also competes, but less directly, with Taco Bell. Finally, other fast-food restaurants, such as Wendy’s and McDonald’s are more distant competitors.

When considering Chipotle’s market and market segment, there are several important considerations to keep in mind. Remember: a market refers to the overall pool of potential customers for a product or service within a specific industry, and a market segment is a distinct group within a market that is identified by shared characteristics like demographics, needs, or behaviors.

An important element of defining the market and market segments correctly is the determination of the size of the market and its growth rates. If a company defines its market and market segments too narrowly, the firm may celebrate a high market share but may also miss out on opportunities in the broader market. If a company defines its market too broadly, there could be a mismatch between what the company can really offer and what the market demands. Companies must avoid trying to be everything to everyone. It is also important to define the company’s total market, accessible market, and strategically relevant market (SRM). For strategic analysis, formulation, and implementation, the strategically relevant market is the main framework to use when assessing the market size and growth rates, the market dynamics, markets trends, and market attractiveness.

From a strategic management perspective, it is pragmatic and useful approach to consider what restaurant subsector Chipotle inhabits. The restaurant industry has many subsectors, including fast food, fast casual, casual, full-service, and fine dining. Chipotle can be considered to operate in the fast casual sector of the restaurant industry. Chipotle’s market includes fast casual Mexican restaurants. Chipotle’s strategically relevant market can be defined as urban and suburban customers who want quick customizable Mexican-inspired food in a casual dining atmosphere. Chipotle’s market segment is college students and younger millennials, aged 18–30, who want a healthy meal that is sustainably sourced at a reasonable price point. Customers value convenience, such as being able to access Chipotle through digital platforms, and transparency in food sourcing.

Ideally, every company wants to operate in an attractive market. One important factor that determines the attractiveness and profit potential of different industries is the size of the market—more specifically, the size of the firm’s strategically relevant market. A big market is more attractive because there is more demand and more space for various companies to succeed. A second important factor of market attractiveness is the growth rates of the market. A growing market offers growth opportunities for various companies and competitors in an industry, whereas growth in a stagnating or even declining market can only be achieved by taking market share away from competitors. Typically, companies analyze past growth rates as the compound annual growth rate (CAGR). A robust and data-driven forecast of the market’s future CAGR is critical when determining the attractiveness and profit potential of an industry. Beyond the size and growth rates, firms need to understand the industry dynamics in their industry.

Every company that engages in the process of strategy formulation must gain a full understanding of the industry in which the firm operates as well as its market, market segments, and the dynamics affecting the company. This allows the firm to determine the strategic opportunities and threats that the industry, market, and market segments present to the firm, as well as the firm’s strengths and weaknesses that may be leveraged to address these opportunities and threats.

Following the logic of the “3 Cs” of industry players, a firm needs to thoroughly analyze its competitors, its customers, and its company. As it relates to a firm’s external environment, a firm’s competitors include the industry in which a firm operates. A firm’s customers make up the firm’s markets and market segments. The company includes all the internal dynamics of the firm, which is covered in the next chapter, which focuses on analyzing the internal environment.

Understanding a firm’s industry, market, strategically relevant market, and market segment are essential when analyzing a company. When you conduct a case analysis, begin by defining the firm’s industry, market (especially its strategically relevant market), and its market segment.

Application

- Now that you have seen an example of Chipotle’s industry, market, and market segment, identify and discuss the industry, market, and market segment for one of your favorite restaurants.

A firm’s industry, market, and market segments play a crucial role in shaping strategy and performance. An industry is a group of businesses that engage in similar business activities and that produce or sell similar products or services. A market refers to the overall pool of potential customers for a product or service within a specific industry, and a market segment is a distinct group within a market that is identified by shared characteristics like demographics, needs, or behaviors.

4.5 Analyze the General Environment

The general environment is the broadest level of the external environment of a firm and includes societal events and trends that impact all firms in an industry.

Although factors in a company’s general environment are the furthest away from the firm and include those factors that the firm has the least influence over, these factors influence the success of a business. Executives must continuously scan and monitor developments in the general environment.

An organization’s general environment presents both opportunities and threats. For example, the rapidly changing landscape of technology, with developments in AI and cloud computing, offers potential opportunities for many companies. Advances in solar and wind power also can be sources of opportunities in the external environment as many companies move toward goals of net-zero emissions.

The general environment is also a source of threats that must be mitigated to ensure continued company success. For example, wars pose threats to supply chains. Changing tariffs on imports threatens trade balances. Successfully navigating these external forces is key to ensuring a company’s sustained success and maintaining its competitive position.

The PESTEL Framework

The PESTEL framework is the strategic management framework that you use to analyze the general environment. Each letter of the acronym PESTEL represents a factor in the general environment: political, economic, sociocultural, technological, environmental, and legal.

There are many elements that make up each factor in the PESTEL framework. Figure 4.4 and the explanation following it include an illustrative list of elements that make up each PESTEL factor.

| Political | Economic | Sociocultural | Technological | Environmental | Legal |

|---|---|---|---|---|---|

| Type of law: administrative law = governmental regulation | Economic growth | Population growth / decline / density | Level of technology | Impact of climate crisis | Type of law:

Statutory law = passed by Congress Case law = adjudicated in courts |

| Tax regulations | Inflation rates | Age, gender, and ethnicity distribution | Life cycle of technology | Weather | Level of law: national, state, local |

| Immigration regulations | Exchange rates | Attitudes toward inclusiveness | Level of technological innovation | Natural disasters | Import / export laws |

| Foreign trade regulations | Interest rates | Role of family in society | Rate of new technology development | Pollution | Antitrust laws |

| Health and safety regulation (OSHA) | Stability / volatility of stock market(s) | Health consciousness | Internet infrastructure: urban vs. rural | Recycling infrastructure | Copyright and patent laws |

| Presidential executive orders | Household disposable income | Lifestyle attitudes | Communications infrastructure: urban vs. rural | Regenerative agriculture | Consumer protection laws |

| Political stability | Job market growth | Cultural attitudes | Digital divide / access to new technology | Availability of organic products as supplies | Labor laws |

| Political corruption | Unemployment rates | Career attitudes | Automation and robotics | Availability of recycled products as supplies | Antidiscrimination laws |

| Degree of political division | Gross domestic product | Risk vs. safety focus | Generative AI, cloud and quantum computing, augmented reality (AR) and virtual reality (VR) | Renewable energy infrastructure | Environmental laws |

Figure 4.4: PESTEL framework

Political

The political factor in the PESTEL framework focuses on the ways in which governments shape businesses.

It can be easy for students first learning the PESTEL framework to confuse the political category with the legal category. We review the legal factor later in this section. One distinction is that governmental regulations are best categorized as political.

To understand governmental regulations that are best categorized as political and how this differs from what is best categorized as legal, it is helpful to briefly review how government regulation is created through the federal executive branch of government because this is the governmental regulation the PESTEL framework’s political factor concerns.

In the U.S., there are three branches of government: the executive, legislative, and judicial. There are also three levels of government: federal, state, and local. There are multiple types of law, and they are created through different governmental processes by different branches of government.

Federal executive governmental agencies, such as the Occupation Safety and Health Organization (OSHA), make administrative law. The administrative law made by governmental agencies form the basis of federal governmental regulations. Administrative law that regulates business is binding, and companies must follow it. A few of the governmental regulations that business must follow are tax regulations, immigration regulations, foreign trade regulations, and OSHA regulations that address employee health and safety.

In addition to promulgating regulations, the federal executive branch of government in the U.S. also issues presidential executive orders. For example, a July 9, 2021, presidential executive order by then-President Joe Biden titled “Executive Order on Promoting Competition in the American Economy” directly impacts businesses. Statutory and case law are reviewed under the legal section of the PESTEL framework.

Types of governmental regulation differ in different countries. When U.S. companies operate outside of the United States, it is important for company legal teams to understand under what conditions U.S. regulations apply and when regulations of the other country apply.

In addition to governmental regulation and presidential orders, there are other aspects of the general environment that are impacted by political factors. Corruption and political instability in a country can also impact the general environment.

Economic

The economic segment of the PESTEL framework focuses on the broad economic events and trends that impact the general environment. These include, and are not limited to, the degree of growth in the economy, inflation rates, exchange rates, and interest rates. It also includes the recent and long-term stability or volatility of the stock market(s). The amount of available household disposable income impacts the general environment. The job market is an essential element of the economic picture of the general environment. This includes job market growth and unemployment rates. The gross domestic product (GDP) of a country is also an important indication of the economic factor for the general environment.

Sociocultural

The sociocultural factor in the PESTEL framework includes a society’s culture, norms, and values. A sociocultural aspect to consider when analyzing the general environment is composition of the population, including population growth and decline and its density. Considering the percentage of the population that lives in urban, suburban, and rural communities is valuable. It is also valuable to analyze the age, gender, and ethnic distribution across a population. Perspectives can vary among different groups.

Understanding attitudes and values across multiple dimensions of the population can give a helpful picture of the sociocultural factor of the PESTEL framework. Consider attitudes and values toward the role of family in society and health consciousness. Attitudes and values about work-life balance and general lifestyle, as well as attitudes and values toward careers, can be important sociocultural factors to consider.

Changing values at work that are relevant for business now could be:

- Desire and expectation to partially work from home (hybrid work)

- Rights movements like #BLM or #MeToo

- Heightened sensitivity regarding climate change and expectations that business plays its role in fighting it

- Individualism continuing to grow

Analyzing the tolerance for risk can also be helpful when assessing the sociocultural factor of the PESTEL framework.

Technological

Technology influences the general environment in multiple ways. The level of technology in the general environment is important, as is the life cycle of technology. The life cycle of technology, which covers the commercial journey of a new technology from development and growth to decline, may have an influence on the level of technological innovation, which influences the rate of new technology development. Technology is dependent upon the appropriate infrastructures to enable its use. Consider internet and communications infrastructures and how urban and rural environments impact these. The digital divide considers access to technology along geographical and socioeconomic lines. Automation has been important for a while. Robotics is a growing technology that influences the technological factor of the PESTEL framework. Specific new technologies are always important, such as generative artificial intelligence (AI), cloud and quantum computing, augmented reality (AR), and virtual reality (VR).

Environmental

Environmental factors are important when analyzing the general (or macro) environment. The climate crisis is an essential focus of this factor. Weather and natural disasters impact the general environment. Pollution has a large impact. Although many share a value to reuse, repurpose, and recycle, there can be significant variations in the infrastructures that support these values and activities. Regenerative agriculture seeks to balance the needs for food production and the needs of the environment. As more consumers become interested in organic and recycled products, the market for securing organic and recycled supplies is increasing. As many companies set carbon-neutral or net-zero goals, the demand for green energy sources is increasing. The infrastructure to support green energy is an important aspect of the environmental factor for the PESTEL framework.

Legal

In addition to administrative law and presidential executive orders discussed above under the political factor, there is statutory law that is passed by the legislative branch of government, Congress. There also is case or common law that is based on cases adjudicated in the judicial system, the courts. Case law sets precedents that guide future actions. Both types of law must be followed and are categorized under the legal factor of the PESTEL tool. In addition to understanding where law is made, it is also useful to understand at what level of government the law has been passed—federal, state, or local—because this indicates the jurisdiction of the law. Some of the federal law that impacts businesses include import and export laws, antitrust laws, and copyright and patent laws. Federal laws that govern consumer protection, labor, and antidiscrimination are also crucial focuses of the legal factor. Federal environmental laws address ways businesses interact with the environment.

Now that you understand the PESTEL framework, it is time to conduct an analysis of the general environment. The PESTEL analysis instrument introduced below supports you when you conduct an analysis of PESTEL factors in the general environment. Once you have conducted the analysis, the instrument structures your interpretation of the analysis and your evaluation of the analysis and interpretation. You then make recommendations to the firm based on your analysis, interpretation, and evaluation.

The first step when you analyze the general environment using the PESTEL analysis instrument is to analyze the case data related to each PESTEL factor.

PESTEL analysis instrument

Download an editable version or view this resource in Appendix 2.

Analyze Data about the General Environment

Step 1

- Methodically and thoroughly examine all the data available about the general environment that relates to each PESTEL factor: political, economic, sociocultural, technological, environmental, and legal.

Step 2

- Identify and classify all the data about the general environment that relates to each PESTEL factor: political, economic, sociocultural, technological, environmental, and legal.

- Questions to ask:

- What information about the general environment relates to each PESTEL factor?

- In which PESTEL factor does this information fit best?

Step 3

- Complete the analysis section of the PESTEL analysis instrument.

Be specific about what data in the case applies to each of the PESTEL factors. Your analysis needs to focus on the present and specific organizational context and must address what is happening with this firm, at this time, in this place, and under these circumstances. Avoid making general statements that apply either to many industries or to this company always.

For example, imagine you are analyzing Ford Motor Company, and you are considering the impact of governmental regulations and policy on sales. Avoid statements like, “Governmental regulation impacts sales.” This statement applies to many industries and has applied to Ford for some time. Although the statement is true, being more specific is helpful. Instead, you may analyze the influence of governmental regulations and policy on Ford, writing something along the lines of “The IRS $7,500 tax credit for new plug-in electric vehicles (EVs) or fuel cell vehicles (FCVs) influenced Ford sales in 2023 by X%. President Trump’s retrenching of governmental support for clean technologies threatens Ford’s sales of EVs and FCVs.” It takes a thorough knowledge of the case to be able to provide this much more robust analysis of the influence of political regulation and policy on Ford. Continue to analyze the influence of governmental regulation and policy on Ford until you have exhausted an analysis of all the data in the case that relates to the political factor. When you have exhausted your analysis of the influence of the political factor on Ford, move onto analyzing the economic, sociocultural, technological, environmental, and legal factors. This level of detail in your analysis supports the next steps in the analysis process: interpretation and evaluation.

After completing your analysis related to each PESTEL factor, your next step is to interpret the analysis.

Interpret the Analysis

Step 1

- Examine the analysis of each PESTEL factor: political, economic, sociocultural, technological, environmental, and legal.

Step 2

- Identify and explain whether, how, and in what ways the information in the analysis is related.

- Questions to ask:

- How does your analysis within each PESTEL factor relate?

- How do the political factors relate?

- How do the economic factors relate?

- How do the sociocultural factors relate?

- How do the technological factors relate?

- How do the environmental factors relate?

- How do the legal factors relate?

- How does your analysis in each PESTEL factor relate to your analysis of other PESTEL factors?

- For example: How does your analysis of the political factor relate to your analysis of the legal factor? Continue this until you have considered all combinations of factors that are relevant to the case.

- What elements of your analysis of PESTEL factors were a surprise?

- Are there incongruencies between the elements of analysis of PESTEL factors?

- How does your analysis within each PESTEL factor relate?

Step 3

- Identify and explain underlying root cause(s) of the situation.

- Question to ask:

- What may be causing the information identified in your analysis of PESTEL factors?

Step 4

- Complete the interpretation section of the PESTEL analysis instrument.

The next step is to evaluate the interpretation of your analysis.

Evaluate the Analysis and Interpretation

Step 1

- Examine the analysis and interpretation you have just completed.

Step 2

- Identify and explain whether, how, and in what ways the information in the analysis and interpretation in the PESTEL analysis instrument impacts the industry and company.

- Questions to ask:

- How does each element of the analysis and interpretation in the PESTEL analysis instrument impact the industry and company?

- From a holistic point of view, looking across all the information in the analysis and interpretation in the PESTEL analysis instrument, how does the information impact the industry and company?

Step 3

- Identify and explain whether, how, and in what ways the information in the analysis and interpretation PESTEL analysis instrument is relevant to the industry and the company.

- Questions to ask:

- How is each element of the analysis and interpretation in the PESTEL analysis instrument relevant to the industry and company?

- From a holistic point of view, looking across all the information in the analysis and interpretation in the PESTEL analysis instrument, how is the information relevant to the industry and company?

Step 4

- Determine how important the information is to the industry and the firm.

- Action to take (if helpful):

- Rank the analysis and interpretation PESTEL analysis instrument according to strength of importance, such as strong, moderate, or weak.

Step 5

- Identify the company’s current, potential, or needed assets, organizational capacity, and managerial ability that may support or mitigate the areas of highest impact, relevance, and importance for the firm.

- Questions to ask:

- What are the company’s current, potential, or needed assets that may support or mitigate the areas of highest impact, relevance, and importance for the firm?

- What is the company’s organizational capacity that may support or mitigate the areas of highest impact, relevance, and importance for the firm?

- What managerial ability does the company possess that may support or mitigate the areas of highest impact, relevance, and importance for the firm?

Step 6

- Complete the evaluation section of PESTEL analysis instrument.

The final step is to recommend action to the firm based on your analysis, interpretation, and evaluation.

Recommend Action to the Firm

Step 1

- Make recommendations to the company to leverage opportunities in the general environment.

Step 2

- Make recommendations to the company to mitigate threats in the general environment.

Step 3

- Place the recommendations in the instrument in the section titled “Recommendations.”

A PESTEL framework takes a snapshot of the general environment. Building on this snapshot, the PESTEL analysis instrument enables you to interpret the analysis, evaluate the analysis and interpretation, and make recommendations to the firm. This transforms a PESTEL analysis from a static picture of the general environment to a dynamic process that considers the elements within the PESTEL analysis, which is much more helpful to a firm than a static snapshot.

When you analyze a case, use the strategic management framework and the analysis instrument to support your analysis. The goal is not to complete every aspect of the analysis instrument with the same degree of information. The goal is to thoroughly analyze the data in the case.

When you analyze a case, you analyze the specific PESTEL factors present in the case. Each factor in a case does not necessarily impact the case to the same degree. For example, you may find that the political, sociocultural, technological, and legal factors have the greatest influence on a case and that economic, sociocultural, technological, and environmental factors influence another case.

We have now considered the general environment, which is the first and broadest level of a firm’s external environment. We also reviewed the PESTEL framework, which is the strategic management framework that is used to analyze the general environment. You have completed a PESTEL analysis using the PESTEL analysis instrument. It is now time to turn your attention to the next level of the external environment: the industry environment.

Application

- Choose one of your favorite companies.

- Apply the PESTEL framework to that company.

- Give an example of each factor, and explain how your examples illustrate each PESTEL factor.

- Use the PESTEL analysis instrument to structure your analysis, interpretation, and evaluation. What recommendations would you make to the company based on your analysis?

The PESTEL framework is the strategic management framework that you use to analyze the general environment. Each letter of the acronym PESTEL represents a factor in the general environment: political, economic, sociocultural, technological, environmental, and legal.

Bibliography

Porter, M. E. (1979, March–April). How competitive forces shape strategy. Harvard Business Review, 57(2), 137–145.

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. Free Press.

4.6 Analyze the Industry Environment

The industry environment is the second level of the external environment, and it is narrower in focus than the general environment. Sometimes the industry environment is referred to as the task environment.

The industry environment is important because it includes the dynamics that shape the profit potential and market attractiveness of an industry and the influence of direct competitors on a firm. How profitable a firm may be in an industry is important for many reasons. When company executives are considering entering a new industry, the market attractiveness and profit potential of the industry is essential information. The industry environment also considers the impact of direct competitors. Understanding the industry environment can help executives decide where in an industry to position a company. This is also valuable information when a firm is deciding whether to divest a company in an industry.

The Porter’s Five Forces Framework

The Porter’s Five Forces (P5) framework is the strategic management framework used to analyze the industry environment. The Porter’s Five Forces framework was introduced in a 1979 article by Michael Porter of Harvard Business School.

The framework considers five forces in an industry that influence the profit potential and industry attractiveness in the industry. Executives of companies currently competing in the industry and those considering entering or exiting an industry utilize the Porter’s Five Forces framework to make essential decisions.

The framework is made up of four factors on the outside surrounding a central factor (see figure 4.6). The four outside factors represent opportunities and threats to existing companies in the industry and those firms considering entering or exiting the industry. Executives of companies already competing in the industry need to continuously scan the industry environment and analyze these opportunities and threats. Businesses considering entering or exiting the industry consider these factors when making their decision. Rivalry among existing competitors, which is in the center of the Porter’s Five Forces framework, represents the relationships of companies currently competing in the industry.

Porter’s Five Forces framework is a dynamic framework, as the forces interrelate and impact each other. When none of the five forces work to undermine profits, then the profit potential of the industry is strong. If all the forces work to undermine profits, then the profit potential of the industry is weak. Most industries fall between these extremes.

Bargaining Power of Suppliers

When suppliers have a high bargaining power, there is less industry profit potential, and when suppliers have a low bargaining power, there is more industry profit potential.

High Bargaining Power of Suppliers Means Less Industry Profit Potential

When suppliers have greater leverage over the competitors in an industry than the competitors in the industry have over the suppliers, then the bargaining power of suppliers is high. Suppliers can increase their prices either incrementally or suddenly. A price increase from suppliers reduces competitors’ profit margins and can have a detrimental impact on their success. Suppliers can also analyze the potential value of entering the market as a competitor.

As seen in figure 4.7, there are multiple factors that contribute to suppliers in an industry having high bargaining power, including the following.

- Incumbent firms experience high switching costs as they change suppliers.

When incumbent firms experience high switching costs when changing suppliers, this gives the current supplier a high bargaining power. There are many reasons an incumbent firm may experience high switching costs. For example, a company may experience financial switching costs due to a disruption in supply chains during a change in suppliers. Firms may also experience high psychological switching costs when they have longstanding and productive relationships with suppliers that enable quick resolutions of any potential problems. In both instances, the supplier has a high bargaining power over the incumbent firm.

- There are no substitutes for the supplier’s products or services.

When there are no substitutes for the supplier’s products or services, the current supplier has a high bargaining power. Imagine a company that has no immediate alternatives of suppliers to choose from. Until other suppliers arrive in the market, the current supplier has a monopoly on the company’s supply, giving the supplier very high bargaining power.

- The supplier’s products are differentiated.

When the supplier’s products are differentiated, the supplier has multiple product lines, meaning a single product is a smaller portion of the supplier’s total business. In this case, the supplier is less dependent on a single product and can afford to hold out for favorable prices, distribution contracts, or other conditions. This gives the current supplier a high bargaining power.

- The supplier can compete in the new industry.

When the supplier can compete in the new industry, it is possible for the supplier to enter the industry as a competitor to incumbent firms. This gives the current supplier a high bargaining power because incumbent firms are motivated to keep out a new competitor.

- Incumbent firms rely on suppliers to be profitable.

When incumbent firms rely on suppliers to be profitable, any changes to the supply quantity, quality, and availability will have an immediate impact on the incumbent firm’s bottom line. In this case, the current supplier has a high bargaining power.

- Suppliers are dominated by a few companies.

When suppliers are dominated by a few companies, incumbent firms have fewer choices of suppliers. This gives the current supplier has a high bargaining power.

Low Bargaining Power of Suppliers Means More Industry Profit Potential

When suppliers have less leverage over the competitors in the industry than the competitors in the industry have over the suppliers, then suppliers have less bargaining power. Suppliers may need to lower their prices to remain suppliers to the industry. This strengthens competitors’ profit margins and increases the probability of their success.

Bargaining Power of Buyers

Buyers are the customers to the industry’s incumbent firms. When buyers have a high bargaining power, there is less industry profit potential, and when buyers have a low bargaining power, there is more industry profit potential.

High Bargaining Power of Buyers Means Less Industry Profit Potential

When buyers have greater leverage over the competitors in an industry than the competitors in the industry have over the buyers, then the competitors may be forced to lower their prices or increase the quality of their products. This weakens competitors’ profit margins and makes them less likely to be prosperous. The power of buyers increases when they demand a lower price or higher-quality product because this impacts the profit margin of the industry’s incumbent firms. Buyers can also analyze the potential value of entering the market as a competitor.

Low Bargaining Power of Buyers Means More Industry Profit Potential

When buyers have less leverage over the competitors in an industry than the competitors in an industry have over the buyers, then competitors can raise their prices and enjoy greater profits.

Industry Concentration

Both suppliers and buyers have more bargaining power in concentrated industries. Industry concentration refers to the extent to which large firms dominate an industry; since there are both suppliers and buyers in highly concentrated industries, both benefit from greater concentration.

One way to measure industry concentration is to examine the percentage of total industry output that is produced by the four biggest competitors. An industry has a high concentration when the four biggest competitors in an industry represent 80 percent to 100 percent of the total industry output. When the four biggest competitors have a total industry output of 50 percent to 79 percent, the industry has a medium concentration. An industry has a low concentration when the four biggest competitors in an industry represent less than 50 percent of the total industry output.

Threat of Substitute Products

A substitute is a product or service that comes from outside the existing industry but fills the same need for existing industry customers while offering some additional value. Because they are products or services from outside the industry, substitute products may come close to meeting the current customer need but by a different means. Sometimes substitute products generate a new demand for a product or service that did not previously exist in the industry. A substitute product or service is not the same thing as a product or service offered by a competitor, which is covered under competitive rivalry.

High Threat of Substitutes Means Less Industry Profit Potential

A high threat of substitutes limits the price incumbent firms can charge for their goods. Therefore, a high threat of substitutes reduces industry profit potential.

Sometimes substitutes are so effective that they disrupt the industry, meaning that all or most of the industry demand for the previous product or service becomes obsolete. For example, navigation systems were a big market with products like TomTom that sold many different navigation devices. Customers also paid substantial premiums for cars with an in-bult navigation system. With the emergence of Google Maps, Wayz, Apple Maps, and other navigation apps that are part of everyone’s smart-phone, the market has shrunk significantly. Navigation apps on smart-phones have substituted dedicated navigation devices, disrupting the industry. An industry that is threatened by such a disruption due to possible substitute products and services is unattractive.

Low Threat of Substitutes Means More Industry Profit Potential

A low threat of substitutes has little impact on the price incumbent firms can charge for their products and services. A low threat of substitutes increases industry profit potential.

Threat of New Entrants

New entrants are companies that are not currently competitors in the industry but may become competitors in the future. A primary difference between the threat of substitutes and the threat of new entrants in the Porter’s Five Forces framework is that the threat of substitutes concerns products or services that come from outside the industry but fill the same need for existing industry customers while offering some additional value, while the threat of new entrants analyzes the threat of companies that are not currently competitors in the industry but may become competitors in the future. The more profit potential an industry has, the more attractive it is to potential new entrants.

High Threat of New Entrants Means Less Industry Profit Potential

There are many factors that contribute to a high threat of new entrants. The three previous forces we have considered—threat of substitute products, bargaining power of buyers, and bargaining power of suppliers—can contribute to a high threat of new entrants. When suppliers consider entering the market as a competitor, they become a threat as a new entrant. When buyers consider entering the market as a competitor, they become a threat as a new entrant. The company that makes a substitute product or service is likely to become a new entrant. This illustrates the interrelationships of the forces in the Porter’s Five Forces framework.

Low Threat of New Entrants Means More Industry Profit Potential

There are barriers that reduce the threat of potential new entrants to existing firms in the industry. These are referred to as entry barriers.

| Potential barrier | Relation |

|---|---|

| Economies of scale | When the scale needed for the lowest possible production cost is high, the threat of entry is lowered. |

| Capital requirements | When capital requirements to enter a new industry is high, the threat of entry is lowered. |

| Advantages independent of size | When incumbent firms possess high levels of brand loyalty, favorable locations, proprietary technology, cumulative learning and experience, and preferential access to supplies and distribution channels, the threat of entry is lowered. |

| Switching costs | When switching costs are high, the threat of entry is lowered. |

| Network effects | When network effects are present, the threat of entry is lowered. |

| Government policy | When governmental policy restricts competition, the threat of entry is lowered. |

| Expected retaliation | When a new entrant expects incumbent firms to retaliate, such as by initiating a price war when they enter the industry, the threat of entry is lowered. |

Figure 4.9: Entry barriers to new entrants

Economies of Scale

Economies of scale are cost advantages that firms with large outputs have because they can spread their fixed costs across more units of production. Some of these fixed costs include, but are not limited to, many of the functional business units, such as finance, accounting, human resource management, information technology, and sales and marketing. They also may be able to capture some efficiencies by using technology in more innovative ways and creating a more specialized work force. When the scale needed for the lowest possible production cost is high for a potential new entrant into the industry, the threat of entry is lowered.

Capital Requirements

Capital requirements are related to economies of scale. Capital requirements include the investment required to enter a new industry. When capital requirements to enter a new industry are high, the threat of entry is lowered.

Advantages Independent of Size

Incumbent firms in an industry have advantages independent to size. Some of these include high levels of brand loyalty, favorable locations, and proprietary technology. In addition to these advantages, incumbent firms also have the advantage of the cumulative learning and experience they have acquired from being successful in their industries. They may also have established preferential access to supplies and distribution channels. When incumbent firms possess high levels of brand loyalty, favorable locations, proprietary technology, cumulative learning and experience, and preferential access to supplies and distribution channels, the threat of entry is lowered.

Switching Costs

Switching costs are the costs that customers incur when they switch from one vendor to another. Switching costs are most often monetary. They can also be psychological. When a customer is loyal to a brand and switches to another brand, there can be a psychological cost to the customer in switching to the new vendor. There are mental or emotional barriers to making a switch. Brand loyalty is a classic example. Customers of music streaming platforms might resist switching to a competitor because of familiarity and comfort with the service they use. A Spotify customer may be hesitant to switch to Apple Music and may experience a drain on their mental energy as they navigate the learning curve of using a new system. They may also experience an emotional drain as music platform loyalty may be shared by friends and their friends may not be using the new service. When switching costs are high, the threat of entry is lowered.

Network Effects

Network effects are the positive effects one user has on other users of a product or service. The stronger the network effect, the higher the value of a product or service when the number of users increases. Network effects can be encouraged through friends and families. They can also be encouraged through social media and the use of influencers to be associated with a product or service. When network effects are present, the threat of entry is lowered.

Government Policy

Governmental policy can have either positive or negative effects on the threat of potential new entrants to an industry. When governmental policy encourages competition, the threat of entry is raised. When governmental policy restricts competition, the threat of entry is lowered.

Expected Retaliation

Incumbent firms with longevity in an industry have the capacity to enter and withstand a price war when a new firm enters the industry. The new entrant may not have the capacity to withstand this tactic. The fact that incumbent firms may enter a prolonged price war is an example of expected retaliation. The expected retaliation must be credible to deter a potential new entrant to an industry. When a new entrant expects incumbent firms to retaliate, such as by initiating a price war when they enter the industry, the threat of entry is lowered.

Rivalry among Existing Competitors

Unlike the four aspects on the outside of the Porter’s Five Forces framework, which represent opportunities and threats to existing companies in the industry and opportunities for firms considering entering or exiting the industry, rivalry among existing competitors represents the relationships of companies currently competing in the industry.

Competition among rival firms in an industry can be intense. Companies seek to differentiate their products and services from those of their competitors.

Differentiation is how a company makes its products distinct from its competitors. How Apple makes a Mac distinct from a PC and an iPhone different from a Galaxy phone are examples of differentiation.

Businesses use a variety of marketing approaches to communicate the ways in which their products and services are differentiated from those of their competitors. Companies also compete in a highly competitive market through new offerings and price cuts to maintain and attract new customers. High levels of rivalry in an industry reduce the profit potential of the industry.

As the arrows in the Porter’s Five Forces framework show, the four forces on the outside of the framework—the bargaining power of suppliers, and the bargaining power of buyers, the threat of substitutes, and the threat of new entrants—all exert pressure on the rivalry of competitors.

When the five forces are low, then the profit potential and market attractiveness of the industry is strong.

Now that you understand the Porter’s Five Forces framework, it is time to conduct an analysis of the industry environment using the Porter’s Five Forces analysis instrument included in Appendix 3. The instrument structures your interpretation of the analysis and your evaluation of the analysis and interpretation, enabling you to then make recommendations to the firm based on your analysis, interpretation, and evaluation.

Porter’s Five Forces analysis instrument

Download an editable version or view this resource in Appendix 3.

Follow a similar process as that outlined in section 4.5 for the PESTEL analysis.

The Porter’s Five Forces framework is a valuable framework for analyzing the industry environment. It is most productive to consider each aspect of the framework in turn. A Porter’s Five Forces analysis is generally framed as analyzing more dynamic features of the external environment than does the PESTEL framework. This is because the five elements of the framework are dynamic and interrelated.

In using the Porter’s Five Forces analysis instrument, you interpret the analysis, evaluate the analysis and interpretation, and make recommendations to the firm, which is made more effective thanks to the dynamic nature of Porter’s Five Forces analysis.

Collaboration

Porter’s Five Forces framework is useful, but it has limitations. The Porter’s Five Forces framework assumes the amount of profit potential in an industry is fixed and that, if a firm is to make more profit, it must take that profit from a rival, a supplier, or a buyer. This is not always the case. Some companies collaborate, which creates a larger pool of profit that benefits all parties in the collaboration. Collaboration is reviewed in greater detail in Chapter 9.

Analyze Customers’ Current and Future Needs

While Porter’s Five Forces analysis covers the customer perspective through the perspective of the buying power of buyers, companies need to embark on an even more specific and thorough analysis of customers’ current and future needs to formulate strategy. Every strategy developed must allow the firm to meet or exceed customer needs better than its competitors. Hence, a robust understanding of present and future customer needs is critical for the success of every strategy. The firm must understand who its current and future main customers are. Which market segments, customer groups, and main customers will drive strategic success for the firm? Will the firm serve a variety of smaller customers, or will its future success depend on winning with a few industry-leading customers?

When formulating strategy with a clear right to win, winning with customers is the guiding star of strategy formulation. Hence, the firm must understand the following customer-related key areas.

- Who are the main customers with whom the firm’s future success stands and falls? Who are the industry leaders and drivers in the market that command a high market share that the firm needs to win?

For example, BASF Care Chemicals’ business (producing chemical ingredients for the home and personal care industry) relied heavily on a few key customers like Procter & Gamble, Unilever, L’Oreal, Johnson & Johnson, and Colgate, among others. Without winning with these key customers, BASF’s Care Chemicals business would never be able to reach its visions and strategic objectives.

- Understand and estimate the share of wallet the firm holds with the most important customers who will drive its success. The share of wallet is a metric that measures how much of a customer’s spending goes toward a particular company compared to its competitors. The share of wallet indicates the depth of a client relationship and how well a firm is performing with key customers and against its competitors. A typical strategic objective is to increase the share of wallet with key customers.

- For all customers, but especially the above key customers, the firm must understand the customers’ strategy. Where will key customers go, and how can the firm’s customers strategize through their own products and services? The firm wants to help its (key) customers implement their strategy, which makes the firm a strategic partner and key supplier.

Staying with the BASF Care Chemicals example, Unilever’s corporate strategy revolves around sustainability leadership. Integrating the innovation of sustainable and environmentally friendly chemical ingredients into BASF’s Care Chemicals strategy aligns the firm’s strategy with the strategy of key customers in the market, allowing BASF to form a strategic partnership with key customers and helping them to reach their own strategic objectives.

- What are the customers’ met and unmet needs? The firm wants to understand the key customers’ current and future needs. It is important to understand unmet customer needs because they present an opportunity to drive competitive differentiation by offering solutions for currently unsolved customer problems. This approach also links closely to innovation management as one element of business strategy.

- What are the principle buying factors in the market, and what is the main source for competitive differentiation (like price, technology, innovation, customer service, product portfolio, etc.)?

- What is the cost to serve versus the willingness to pay for key customers?

The process for finding answers to the above strategic questions is called customer exploration. This process of understanding potential and existing customers to uncover their needs, preferences, and buying behaviors is a critical step in developing a customer-centric business strategy. Customer exploration allows organizations to align their products, services, and strategy with what their target customers truly value and are willing to pay for. In a dynamically evolving business environment, successful companies prioritize customer exploration as a continuous activity. It informs product innovation, improves customer relationships, and provides a competitive advantage by adapting to market changes and to shifting customer expectations. Primary and secondary market research are used to better understand customer needs as a guiding star of strategy development.

An easy and effective approach to customer exploration is simply asking key customers what they expect from the firm. Seeking input from key customers is essential for a successful strategy. These input and feedback mechanisms include direct surveys or polls, online reviews and ratings, social media interactions and the use of “big data.” Another important approach in customer exploration is customer journey mapping. This involves tracking the steps a customer takes when interacting with the firm, from initial awareness to post-purchase behavior. A customer journey map highlights the customer’s pain points and areas of opportunity that can be integrated into the strategy development as a means to identify opportunities and threats in the industry.

Application

- Use the same example of one of your favorite companies that you used with the PESTEL framework in section 4.5.

- Now apply the Porter’s Five Forces framework to that company.

- Give an example of each force, and explain how your examples illustrate each Porter’s Five Forces force.

- Use the Porter’s Five Forces analysis instrument to structure your analysis, interpretation, and evaluation. What recommendations would you make to the company based on your analysis?

The Porter’s Five Forces framework is the strategic management framework used to analyze the industry environment. The Porter’s Five Forces framework considers five forces in an industry that influence the profit potential and industry attractiveness of that industry: the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products, the threat of new entrants, and the rivalry among existing competitors. Porter’s Five Forces framework is useful, but it has limitations. The Porter’s Five Forces framework assumes the amount of profit potential in an industry is fixed and that, if a firm is to make more profit, it must take that profit from a rival, a supplier, or a buyer. This is not always the case. Some companies collaborate, which creates a larger pool of profit that benefits all parties in the collaboration. While Porter’s Five Forces analysis covers the customer perspective through the perspective of the buying power of buyers, companies need to embark on an even more specific and thorough analysis of customer’s current and future needs to formulate strategy. Customer exploration is the process of understanding potential and existing customers to uncover their needs, preferences, and buying behaviors. It is a critical step in developing a customer-centric business strategy, allowing organizations to align their products, services, and strategy with what their target customers value and are willing to pay for.

4.7 Analyze the Competitive Environment

The third level of the external environment is the competitive environment, and it is the narrowest in focus, consisting of companies that pursue similar strategies in the same industry. A firm has the most influence over the dynamic influences in its competitive environment.

Strategic Group

A company is a member of a strategic group, which includes firms that pursue similar strategies in the same industry. A strategic group consists of industry competitors that have similar characteristics to each other and differ in important ways from the companies in other strategic groups. Each firm in the strategic group seeks to create and sustain a competitive advantage. There are important differences among strategic groups, such as research and development investment, the use of technology and technology innovation, product differentiation, distribution channels, and even customer service approaches.

Firms in the same strategic group are direct competitors. Competition tends to be more intense among firms in the same strategic groups, which is known as intragroup rivalry. Competition among different strategic groups is intergroup rivalry and is less intense than intragroup rivalry.

To create and sustain a competitive advantage, executives need to know as much as they can about their competitors. This includes understanding their direct competitors in their strategic group as well as dynamics among strategic groups. This analysis supports decisions about where to position a firm relative to its competitor. When considering strategic moves, the strategies being considered or implemented by other members of a strategic group are often the best examples for executives to consider. The strategies pursued by firms in other strategic groups are alternative paths to success and can inform a firm’s strategic choices.

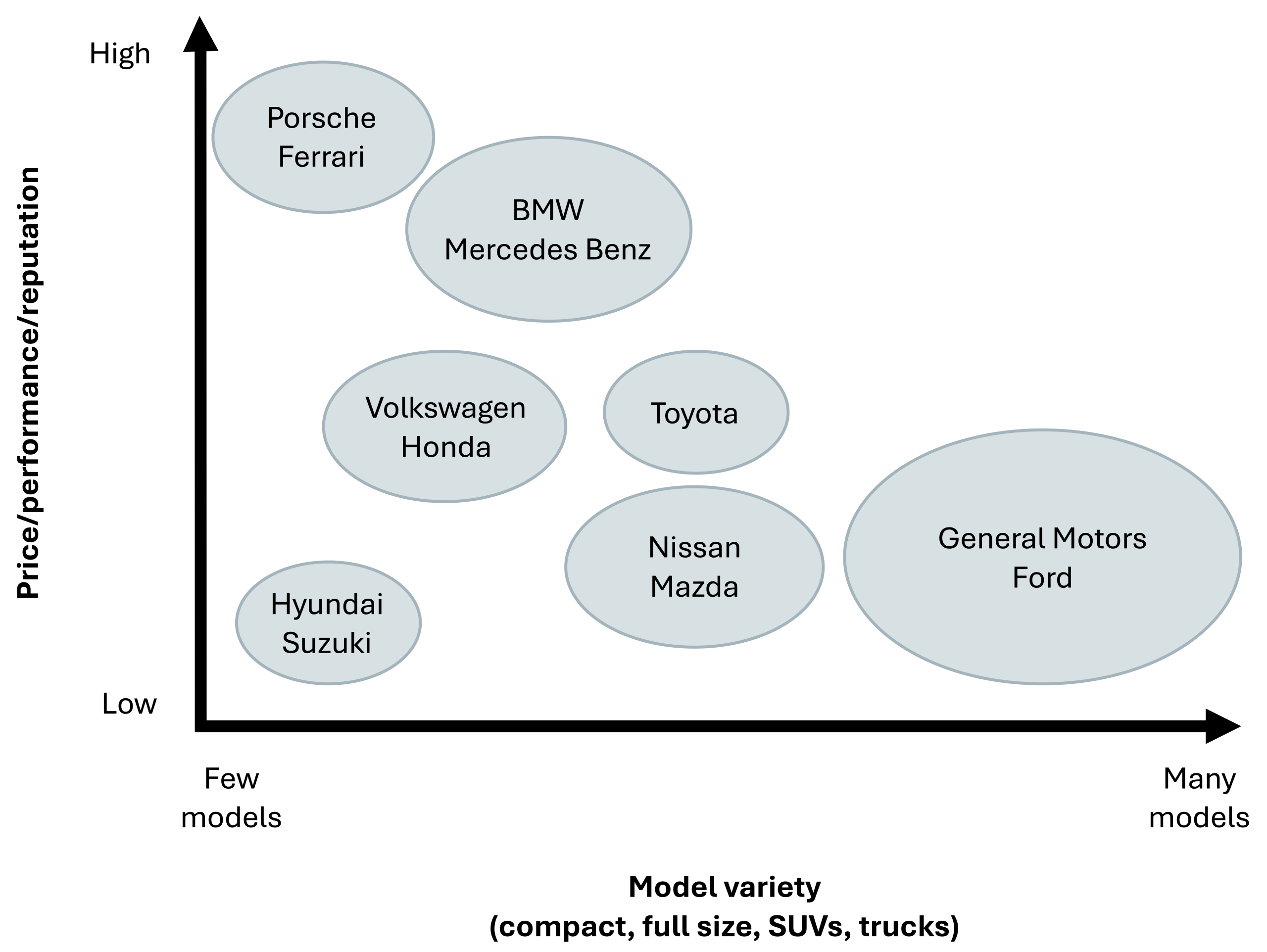

Strategic Group Mapping

Strategic group mapping is the strategic management framework used to analyze strategic groups. It analyzes performance differences among clusters of firms in the same industry. Figure 4.13 shows a strategic group map for the competitive environment of the American automotive industry.

Analyzing strategic groups using the strategic group mapping analysis instrument follows Porter’s Five Forces analysis well because there are similarities between the rivalry among existing competitors in the Porter’s Five Forces analysis and strategic groups in strategic group mapping.

Strategic groups in most industries differ along a few essential dimensions. To map competitors in the same industry into strategic groups, follow these steps:

- Identify the most important dimensions that characterize the strategic groups. These represent company commitments that are both difficult and costly to reverse. They include, but are not limited to, product price, product line, research and development investment, the use of technology and technology innovation, product differentiation, distribution channels, and even customer service. This varies by industry.

- Choose two dimensions from this list of the most important dimensions that characterize the strategic groups.

- Map these two dimensions. Use an X (horizontal) for one dimension, with low on the left and high on the right. Use a Y (vertical) axis for the other dimension, with low at the bottom and high at the top.

- Graph the firms in the strategic group based on these two dimensions using bubbles.

- Indicate the market share of each firm by the size of its bubble.

- Circle those firms with the most in common.

An example of a common X- and Y-axis pair is price and product line. Another common example for one of the axes is business-level strategy.

Strategic group mapping analysis instrument

Download an editable version or view this resource in Appendix 4.

When you conduct a case analysis, you use the strategic group mapping analysis instrument to analyze strategic groups, following a similar process as outlined for the PESTEL analysis. The strategic group mapping analysis instrument structures your analysis.

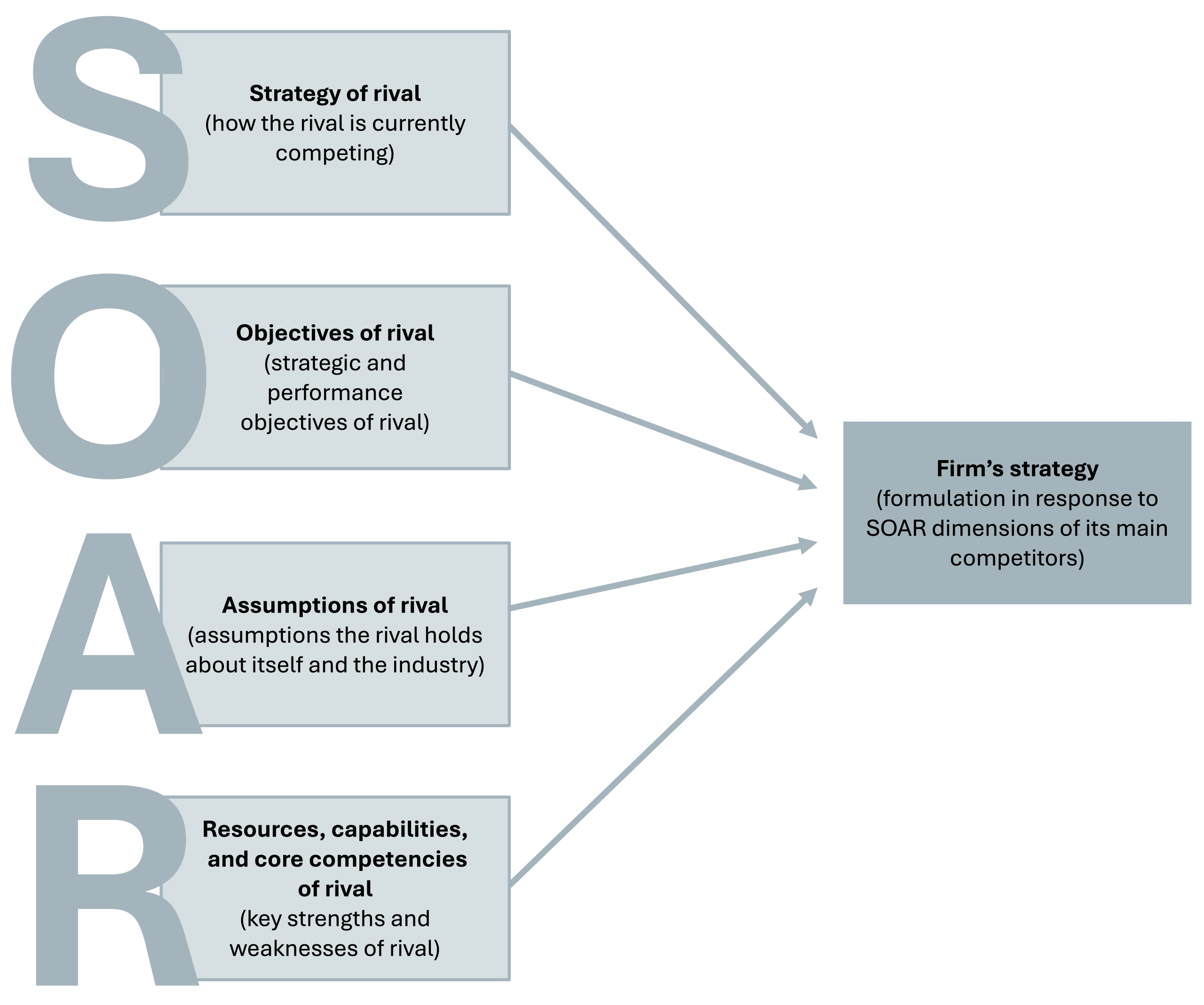

Analyze Competitors’ Strategy and Expected Competitive Moves Using a SOAR Analysis

The strategic group framework provides important information as to the most relevant and most important competitors of the firm. Additional competitive intelligence with information about the main competitors and rivals is necessary and important in anticipating competitors’ next strategic moves. The firm needs to integrate assumptions about these strategic moves into the formulation of the firm’s own strategy. For example, in strategy formulation, it is critical to know if a main competitor intends to enter or leave market segments of strategic importance for the firm. In addition, understanding whether competitors are doing well or not or whether they want to grow aggressively or are satisfied with their current both present critical input to the formulation of a meaningful and robust strategy.

The SOAR framework provides a systematic approach to analyzing and understanding the expected strategic moves of main competitors. SOAR is an acronym that stands for strategy of the rival, objectives of the rival, assumptions of the rival, and resources of the rival.

S: Strategy of the Rival

A robust understanding of a competitor’s expected strategic moves starts with the analysis of the competitor’s current strategy. The firm needs to understand the strategic importance of its own targeted market and market segments the understand the strategy of the competitor. The firm also wants to understand the competitiveness of its rivals today and in the future.

O: Objectives of the Rival

In the second step, the firm analyzes the strategic and performance objectives of its competitor. What are the business aims of the competitor for individual business support units and as a whole? What are the competitor’s objectives for regional and global markets? This will help the firm further understand how intense future rivalry may be and the implications for future market attractiveness.

A: Assumptions of the Rival

In the third step, the firm analyzes the assumptions that a competitor holds about itself and the industry. What is the competitor’s definition of the market, and what are the competitor’s assumptions regarding the development of the market and the industry? Are there any historical (emotional) ties to the business? Are there any national influences that would impact the competitor’s strategy and competitive actions? What is the competitor’s attitude to risk?

R: Resources, Capabilities, and Core Competencies of the Rival

In the fourth step, the firm looks at the resources, capabilities, and core competencies of its rival. The firm wants to understand the strengths and weaknesses of the competitor as well as their possible market exit barriers. For example, knowing that the competitor faces high possible market exit barriers means that it will be more challenging for the firm to push this specific competitor out of the market as part of its own strategy.

Understanding these four elements of the SOAR analysis helps the firm to integrate these dimensions of its main competitors into its own new strategy. This includes answers to these questions:

- Is the competitor happy with the present situation?

- How will the competitor act in all probability?

- What changes could appear in the strategy of the competitor?

- In which areas is the competitor vulnerable?

- Which strategic actions of the firm would provoke a serious strategic response from the competitor?

- Which strategic move would trigger the strongest counterreaction?

After conducting a thorough SOAR analysis, the firm has a much better understanding of competitive moves and responses that the firm needs to integrate into its own strategy formulation process. This allows the firm to make a well-informed decision regarding the strategic “battlefield” in relation to its main competitors.

The idea that a company chooses its battlefield is based on the premise that ideally, a firm wants to offer distinct resources, capabilities, and core competencies to unique markets and market segments. A company aims to avoid a strategy that leads to an overlap in resources, capabilities, and core competencies and/or overlaps in markets and market segments with its competitors.

A firm wants to avoid a strategy that leads the firm to operate in markets and market segments with strong competitive rivalries. The company also aims to avoid competing in the same markets with firms with similar resources, capabilities, and core competencies.

Ideally, the firm wants to avoid a strategy that leads to an overlap in both market segments and resources with its competitors. A strategy that leads the firm to operate in markets and market segments with strong competitive rivalries and compete in the same markets as firms with similar resources, capabilities, and core competencies is a less attractive strategic choice.

Application

- Use the same example of one of your favorite companies that you used with the PESTEL and Porter’s Five Forces frameworks.

- Now apply strategic group mapping to that company.

- Who are the company’s closet competitors?

- Use the strategic group mapping analysis instrument to structure your analysis, interpretation, and evaluation. What recommendations would you make to the company based on your analysis?

A company is a member of a strategic group, which includes firms that pursue similar strategies in the same industry. Strategic group mapping is the strategic management framework used to analyze strategic groups. The SOAR framework provides a systematic approach to analyzing and understanding the expected strategic moves of main competitors. SOAR is an acronym that stands for strategy of the rival, objectives of the rival, assumptions of the rival, and resources of the rival. A firm wants to offer distinct resources, capabilities, and core competencies to unique markets and market segments.

Bibliography

Daems, H., & Thomas, H. (1994). Strategic groups, strategic moves and performance (1st ed.). Pergamon.

Duan, X., & Jin, Z. (2014). Positioning decisions within strategic groups: The influences of strategic distance, diversification and media visibility. Management Decision, 52(10), 1858–1887. https://doi.org/10.1108/MD-08-2013-0415

Geroski, P. A. (1999). Early warning of new rivals. Sloan Management Review, 40(3), 107–116.

Leask, G., & Parker, D. (2007). Strategic groups, competitive groups and performance within the U.K. pharmaceutical industry: Improving our understanding of the competitive process. Strategic Management Journal, 28(7), 723–745. https://doi.org/10.1002/smj.603

Mas-Ruiz, F., & Ruiz-Moreno, F. (2011). Rivalry within strategic groups and consequences for performance: The firm-size effects. Strategic Management Journal, 32(12), 1286–1308. https://doi.org/10.1002/smj.936

Mierzejewska, W., & Dziurski, P. (Eds.). (2023). Business groups and strategic coopetition. Routledge.

Nath, D., & Gruca, T. S. (1997). Convergence across alternative methods for forming strategic groups. Strategic Management Journal, 18(9), 745–760.

Porter, M. E. (1979, March–April). How competitive forces shape strategy. Harvard Business Review, 57(2), 137–145.

Porter, M. E. (2008, January). The five competitive forces that shape strategy. Harvard Business Review, 86(1), 78–93.

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. Free Press.

Robinson, K. C., & McDougall, P. P. (2001). Entry barriers and new venture performance: A comparison of universal and contingency approaches. Strategic Management Journal, 22(6–7), 659–685.

Rosário, A., & Raimundo, R. (2024). Importance of competitive dynamics of strategic groups: Opportunities and challenges. Administrative Sciences, 14(7), 147. https://doi.org/10.3390/admsci14070147

Schimmer, M., & Brauer, M. (2012). Firm performance and aspiration levels as determinants of firm’s strategic repositioning within strategic group structures. Strategic Organization, 10(4), 406–435. https://doi.org/10.1177/1476127012457983

Sonenshein, S., Nault, K., & Obodaru, O. (2017). Competition of a different flavor: How a strategic group identity shapes competition and cooperation. Administrative Science Quarterly, 62(4), 626–656. https://doi.org/10.1177/0001839217704849

4.8 External Environment in Case Analysis

Analyzing the external environment is the second step of case analysis:

2. Analyze the external environment.

- Use strategic management analytical frameworks to analyze, interpret, and evaluate the external environment of the company.

- Use the PESTEL analysis instrument to analyze, interpret, and evaluate the general environment.

- Ensure line of sight and congruence between and among the elements of the PESTEL analysis.

- Use the Porter’s Five Forces analysis instrument to analyze, interpret, and evaluate the industry environment.

- Ensure line of sight and congruence among the elements of the Porter’s Five Forces analysis.

- Use the strategic group mapping analysis instrument to analyze, interpret, and evaluate the competitive environment.

- Use the PESTEL analysis instrument to analyze, interpret, and evaluate the general environment.

- Ensure line of sight and congruence among all strategic management frameworks used.

4.9 Conclusion